Capitalizing on Yield Curve Reversions: How Availability Bias Creates Bond Opportunities

With the markets in flux following the recent FOMC decision, the potential reversion of the yield curve is catching the attention of many investors. Historically, a reversion of the 10-year minus 3-month yield curve has often preceded a recession (What Happens When the Yield Curve Steepens: Lessons from 3 Recessions). During these periods, bonds have outperformed stocks, presenting strategic opportunities for investors to recalibrate their portfolios. As we watch current trends unfold, the question arises: Is now the time to consider positioning into bonds, given their historical performance during previous yield curve reversions?

The Current Yield Curve Landscape

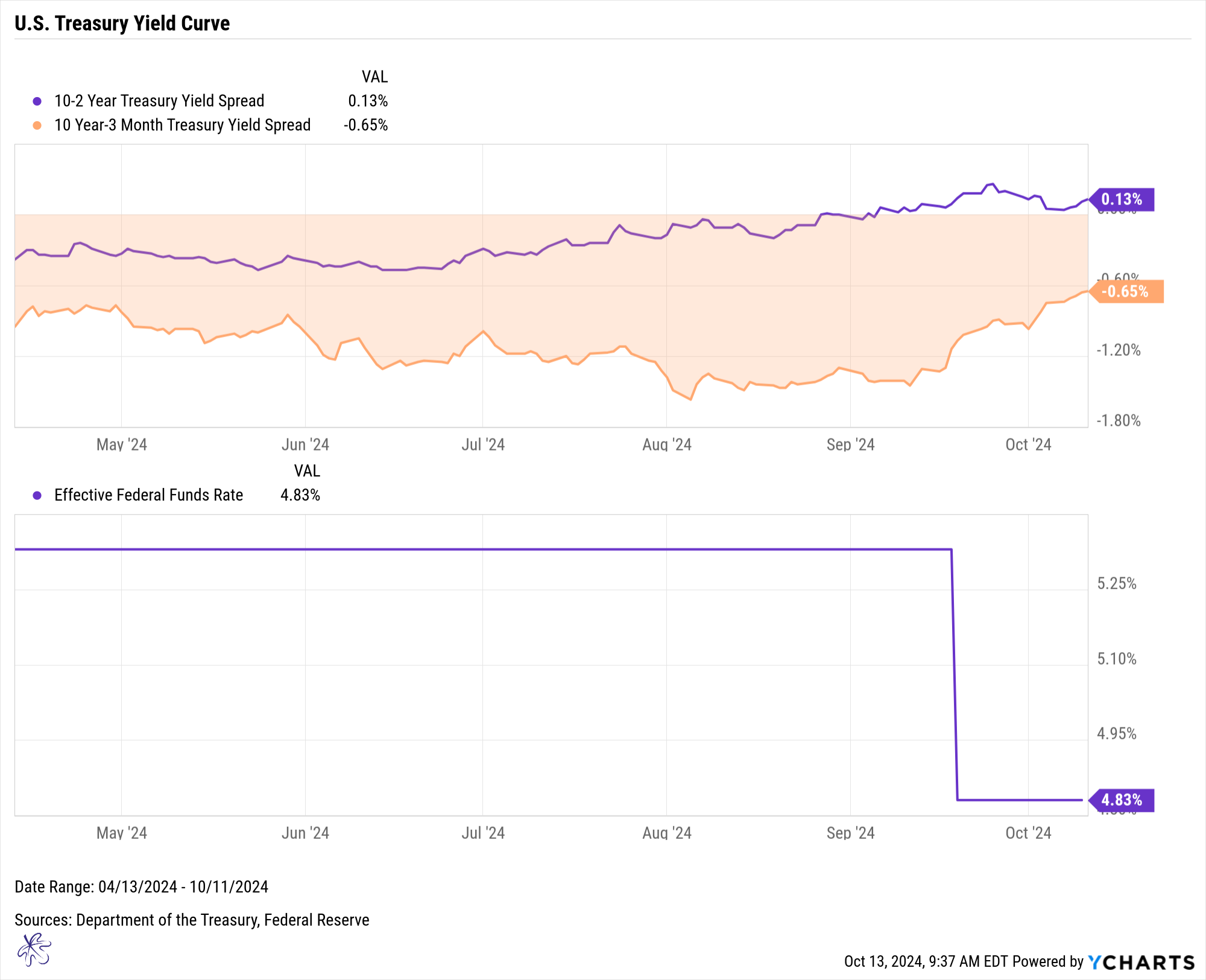

At present, the 10-year minus 2-year yield curve has reverted back to positive, signaling a potential shift in market dynamics. However, the 10-year minus 3-month yield curve remains inverted. Since the FOMC cut rates by 0.50% on September 18, this curve has moved from about 91 basis points inverted to about 65 basis points inverted. We are clearly seeing this curve trend toward reversion, following in the footsteps of the 10yr/2yr curve.

This brings us to an important consideration: When should we start positioning into bonds based on their track record during past reversions? As the yield curve flattens or begins to revert, bonds often become more favorable investments compared to stocks.

The Bond Market’s Recent Movements

Both the 10-year and 30-year Treasury yields moved significantly lower in anticipation of the FOMC rate cut. However, since the cut, the long end of the curve has surged higher. For example, the 10-year Treasury yield jumped from a low of 3.64% to 4.07%. Meanwhile, the 3-month Treasury rate has remained relatively subdued. This divergence has been a primary driver behind the yield curve’s steepening.

I believe that this recent spike in long-term rates following the FOMC easing presents an opportunity to begin building a position in high-quality bonds.

Key Technical Analysis on Bonds

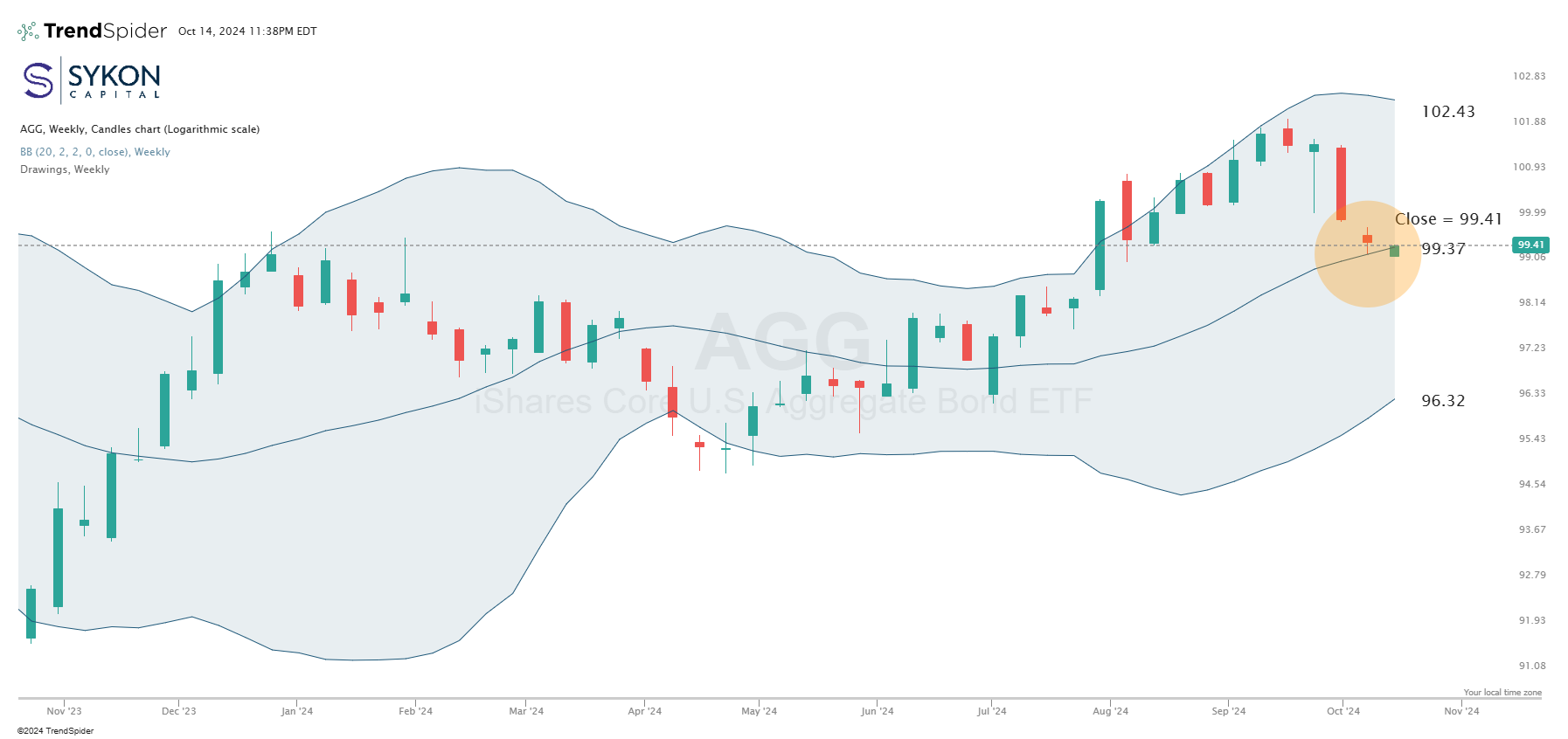

The recent yield rally in bonds has led to a sell-off in the iShares Core U.S. Aggregate Bond ETF (AGG), pushing it back into congestion levels that have previously proven to be key resistance and support levels since 2022. This suggests that bonds may be trading at a critical inflection point.

A look at the weekly candlestick chart of AGG reveals key support at the middle Bollinger band. Holding this middle band could signal a resumption of the uptrend, while a move below it could indicate that the lower band may come into play.

For readers less familiar with Bollinger bands, these bands help identify potential support and resistance levels by analyzing price volatility and trends. On Friday the price of AGG dipped down and then bounced off of this middle Bollinger Band. The open on Monday was below the middle band, but reversed higher to narrowly close above the middle band. The price action over the last two candles is providing evidence of a potentially meaningful support.

Further evidence suggests AGG is likely to hold this middle Bollinger band, as the daily chart is beginning to display a bullish divergence on the ETF. Specifically, while the ETF has made new lows in price, the RSI (Relative Strength Index) is showing a higher low, which typically signals weakening downward momentum. This increases the probability of a short-term bounce or, at the very least, some stabilization in price.

A Timely Opportunity for Portfolio Rebalancing?

If you've been underweight in fixed income, this recent sell-off in bonds could present an opportunity to start building an initial position. Or for those who have been sitting in short term fixed income, this could present an opportunity to extend duration.

In portfolio management, the way we introduce and build a position is just as important as identifying opportunities to invest in. Scaling into high-quality bonds at this time could offer both protection and potential upside as the market digests recent economic shifts.

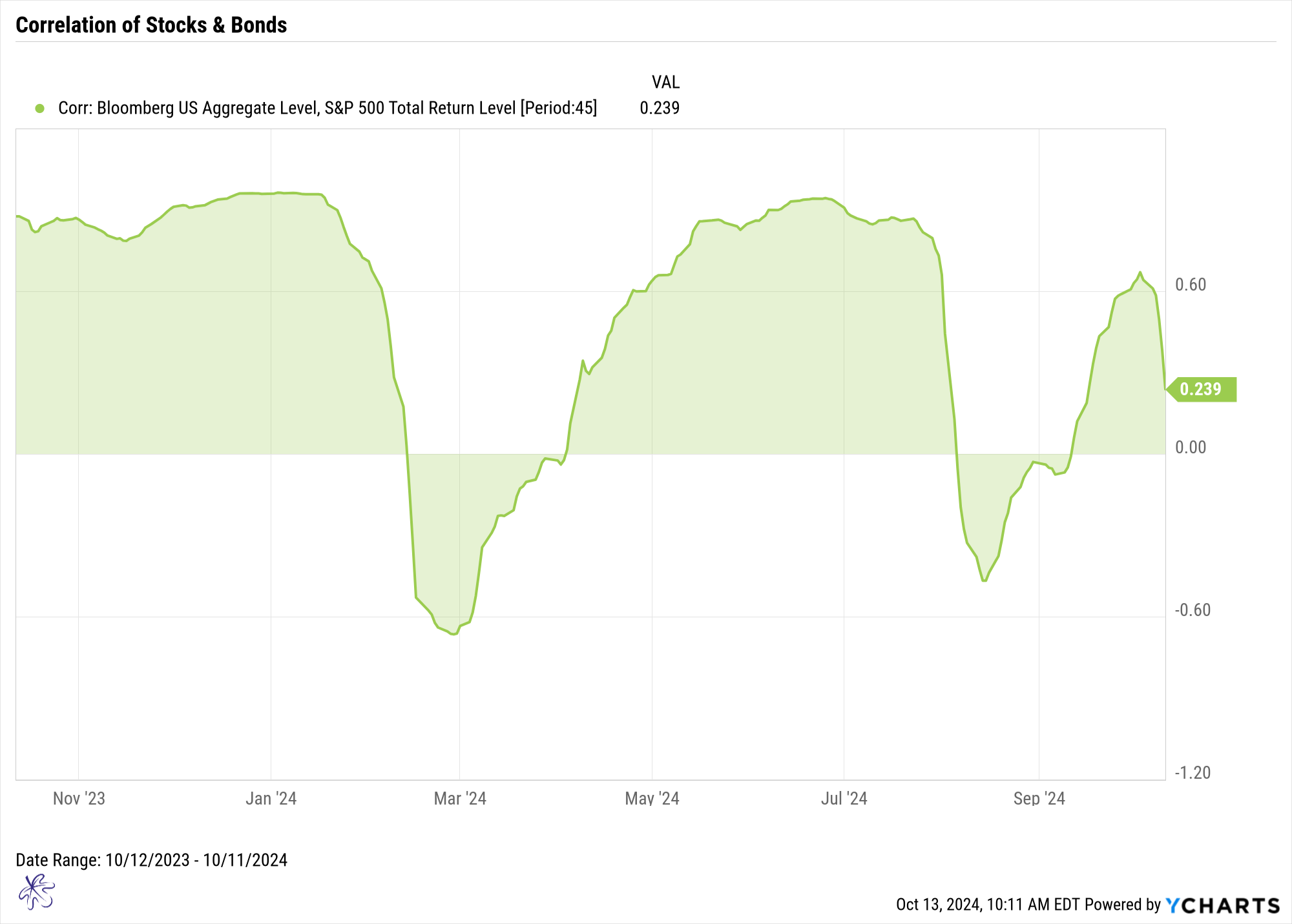

Even if the timing of this position isn't perfect, bonds are starting to offer diversification benefits we haven’t experienced in some time. For example, the correlation between domestic stocks and bonds has dropped from over 0.60 to 0.239. For those unfamiliar with correlations, a reading closer to 0 indicates less relationship between the price movements of the assets, which can enhance diversification of an asset allocation.

Watch Out for Availability Bias and Market Inefficiency

In the current market environment, many investors may fall prey to Availability Bias, a tendency to give undue weight to recent events while ignoring the broader historical context. For example, the significant underperformance of fixed income in recent years might make some investors hesitant to consider bonds, focusing too much on this recent volatility rather than the long-term benefits bonds have historically offered during periods of yield curve reversion.

This bias can lead to a market inefficiency, an opportunity for those who can look beyond recent trends and make strategic decisions based on longer-term historical patterns. As many investors anchor to the short-term movements in stocks or the volatility in bond yields, they may miss out on the advantages of rebalancing into bonds when the yield curve signals potential for relative outperformance.

This creates a window for more informed investors to capitalize on bonds at a time when they may be undervalued or underappreciated. By sidestepping Availability Bias and recognizing the bigger picture, you can position yourself ahead of those who hesitate, taking advantage of inefficiencies created by short-term thinking.

Prepare for What Comes Next

In times of economic uncertainty, yield curve movements are one of the key indicators investors rely on to make informed decisions. The current reversion trends, combined with recent technical signals from the bond market, suggest that now could be an opportune moment to start building a bond position. Even if timing isn't perfect, bonds are offering unique diversification benefits that we haven't seen in a while.

As always, remember that portfolio management is more than just finding opportunities, it's also about how you execute your strategy. Active correlation management and a thoughtful approach to building positions can help ensure that your portfolio remains resilient as market conditions evolve. Now may be the time to revisit your fixed-income allocations and take advantage of the shifts we're seeing in both yield curves and bond prices.