History Says February Is Rough. Will This Time Be Different?

February has been the worst month for the S&P 500 over the past decade, but will 2025 break the trend?

Investors are facing a perfect storm of market uncertainty: weaker-than-expected job growth, shifting expectations for Fed rate cuts, and inflation data that could shake up the outlook. Historically, February tends to be a tough month for stocks, but does that mean investors should brace for a pullback, or is there an opportunity ahead?

Let’s dive into what’s driving the market right now and what history tells us about February’s performance.

Jobs Data Sends Mixed Signals to the Fed

Last week’s headlines were all about employment. The U.S. added 143,000 jobs in January, falling short of the expected 168,000. However, revisions for November and December added over 100,000 jobs to previous estimates, complicating the market’s expectations.

This puts the Federal Reserve in a tough spot. A labor market that remains healthy, though not necessarily strong, reduces the urgency for rate cuts. As a result, market expectations for the Fed’s next rate cut have shifted from June to July, and at this point, only one rate cut is expected over the next 16 months.

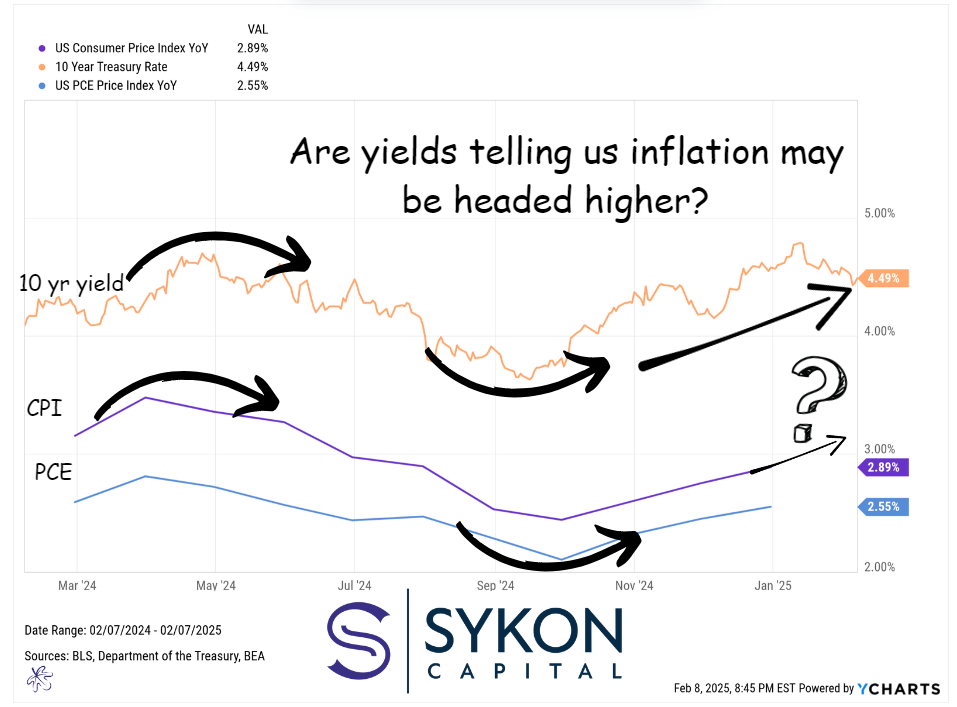

Inflation Data Could Make or Break the Market

All eyes are now on the Consumer Price Index (CPI) report, set for release on Wednesday at 8:30 AM ET. Last month, CPI came in at 2.9%, ticking up from 2.7%, and the median forecast for this month is 2.8%.

But here’s the risk:

- If inflation comes in higher than expected, markets could see a sharp reaction.

- If it meets or beats expectations, optimism for rate cuts may return.

If CPI surprises to the upside, it could shatter hopes for Fed easing and raise concerns that tariffs and supply chain pressures will push inflation higher, potentially putting rate hikes back on the table instead of cuts.

This report is critical because it will help determine whether the Fed maintains its current stance or shifts toward more aggressive action in the coming months.

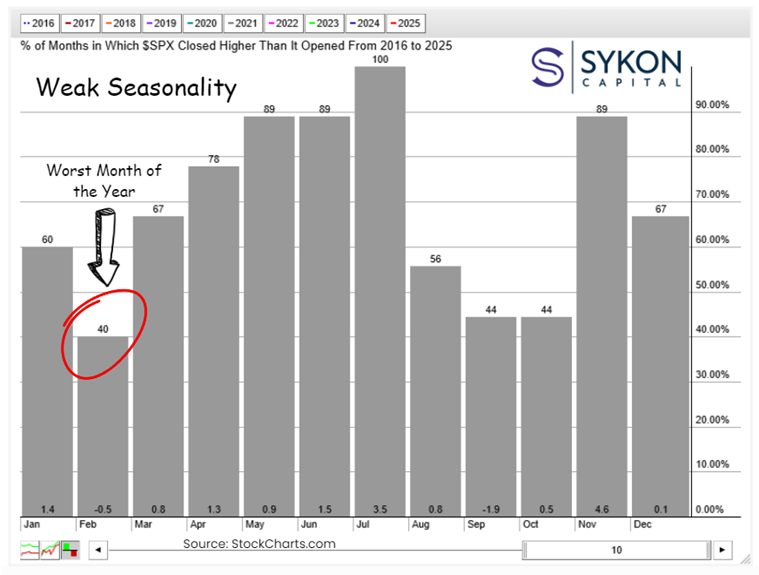

February: The Market’s Worst Month Historically

Even without macroeconomic uncertainty, February has historically been a weak month for stocks. Over the past decade:

- The S&P 500 has only posted gains in 40% of Februarys

- The average return for the month is -0.5%

While this trend doesn’t necessarily predict the future, it highlights that a market pullback this month wouldn’t be unusual. However, short-term weakness doesn’t mean the rest of the year is at risk.

In fact, the data suggests the opposite: We’re about to enter the strongest five-month stretch for the S&P 500 based on historical trends.

This means investors should remain vigilant in the short term but flexible for opportunities in the months ahead.

Key Takeaways for Investors

- The Fed is unlikely to rush into rate cuts with a resilient job market.

- Wednesday’s CPI data could be a turning point for market expectations.

- February is historically weak, but the months ahead have favored investors.

Short-term volatility is part of investing, but the key is understanding the bigger picture and positioning your portfolio strategically.

If you’re wondering how to navigate this landscape, now is the time to ensure your portfolio is aligned with both opportunities and risks.

Let’s talk about your investment strategy.

SCHEDULE A PORTFOLIO REVIEW