Hot Inflation, Rate Hikes, and a Market That Won’t Quit

Rate cuts? Forget it. The real risk is that the Fed might actually hike rates instead.

For months, the market has been debating how much and how fast the Fed will cut rates in 2025. But with recent employment and inflation data coming in hotter than expected, that question has completely changed.

Now, it’s no longer about how many cuts we’ll get, it’s whether we’ll get any at all.

Or even worse:

Are we looking at the possibility of a rate hike instead?

Inflation Isn’t Cooperating

Wednesday’s CPI report threw cold water on the cooling inflation narrative.

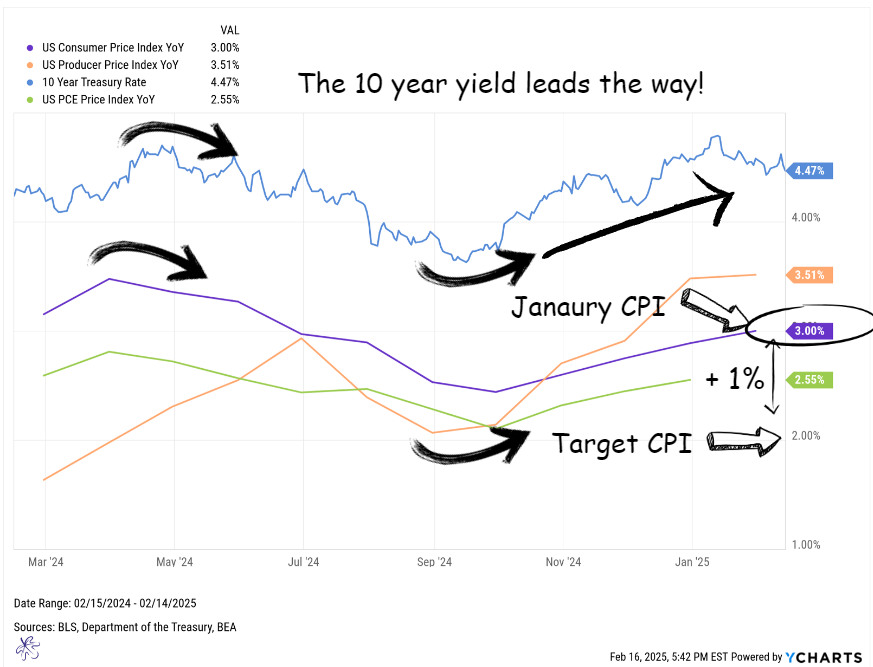

- CPI came in at 3.0% year-over-year, much higher than the 2.8% the market expected.

- That puts us nearly 1% above the Fed’s 2% target, not exactly the trajectory you want if you're hoping for rate cuts.

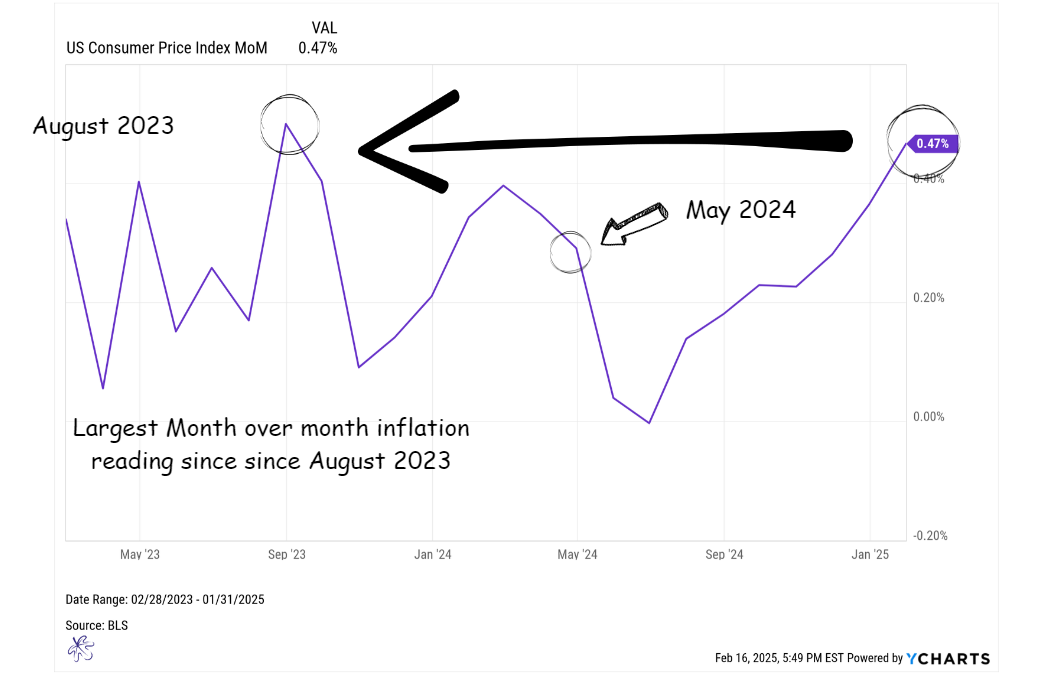

- Month-over-month CPI rose nearly 0.50%, the highest since August 2023. Inflation isn’t rolling over, it’s accelerating.

And it’s not just CPI flashing warning signs:

✅ Producer Prices (PPI) are rising, suggesting companies are experiencing higher costs that will likely trickle down.

✅ The 10-year Treasury yield keeps climbing, meaning bond markets see inflation persisting.

✅ Core PCE (the Fed’s preferred inflation measure) is coming up soon, and if it follows the trend, the rate-cut narrative could take another hit.

The reality? Until we see month-over-month inflation cool off, the year-over-year trend won’t move lower.

Tariffs Could Add More Fuel to the Fire

If inflation wasn’t enough of a concern, tariffs might make it worse.

New trade policies could force companies to raise prices, either due to direct cost increases or supply chain adjustments. Even if businesses can’t pass on 100% of these costs to consumers, inflationary pressure is inevitable.

The bottom line? Inflation may not just be “sticky”, it could start reaccelerating.

And if that happens, the idea of rate cuts will be dead on arrival, the real discussion will be whether the Fed needs to hike rates again to control inflation.

But Wait… Stocks Just Hit New All-Time Highs?!

Now here’s where things get weird.

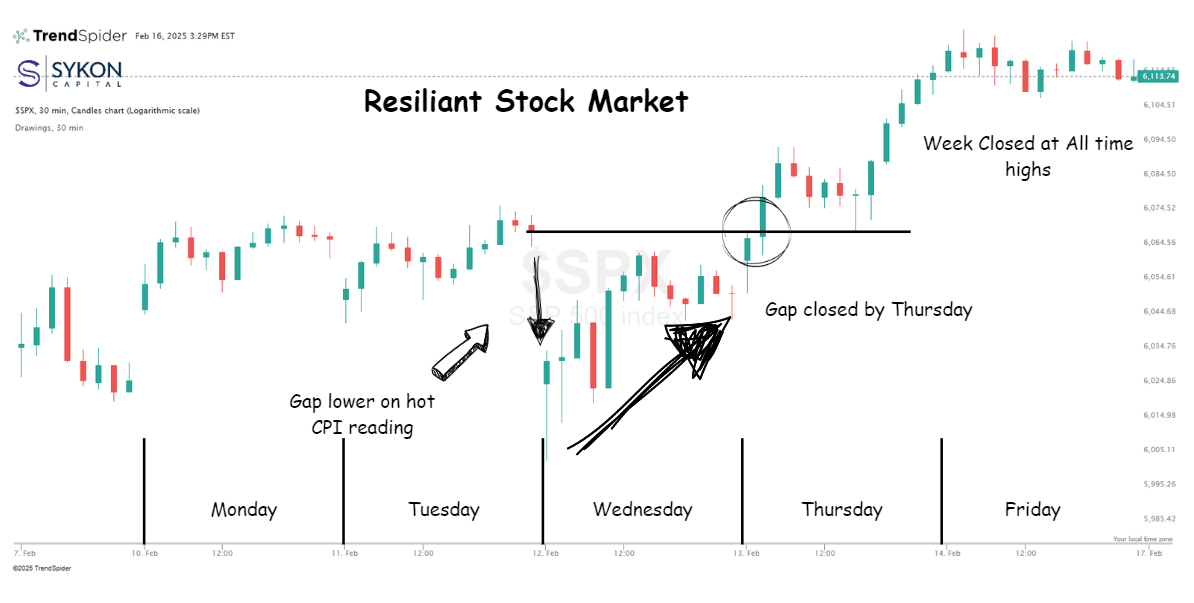

When the CPI report dropped, S&P 500 futures tanked in pre-market trading. A hot inflation report should be bad news for stocks.

But by the end of the day, markets battled back.

By Thursday, they closed the gap.

By the end of the week, the market hit new all-time highs.

How does this make any sense?

- Inflation is heating up.

- The Fed might not cut rates (or could even hike).

- Tariff talks are ramping up.

- Yet… the S&P 500 is at record highs.

I believe there is only one explanation.

One Chart Explains Everything

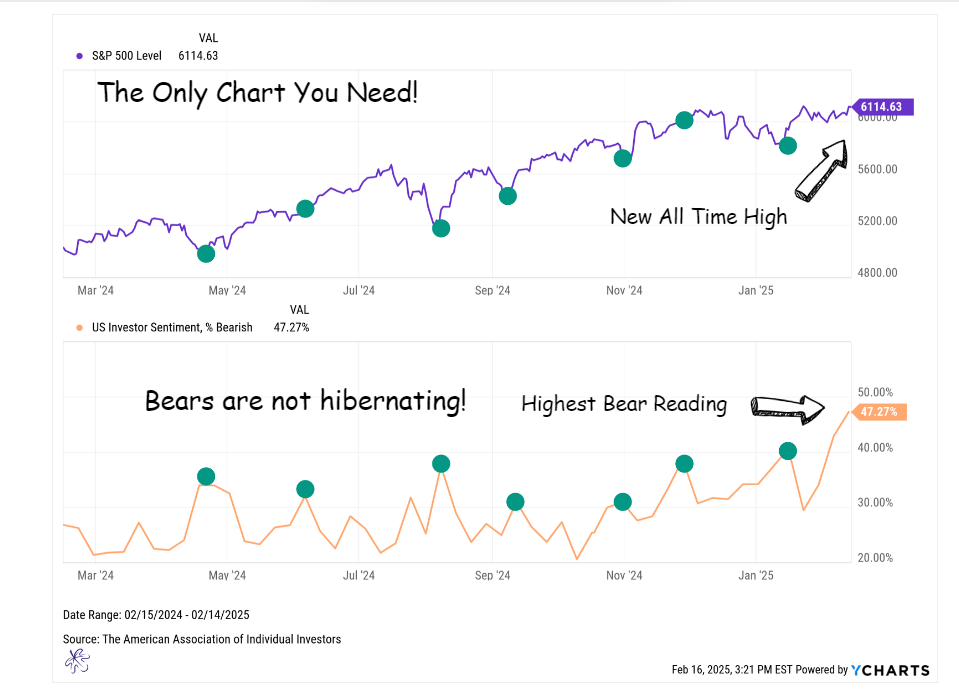

It all comes down to sentiment.

According to the AAII Investor Sentiment Survey, investors are the most bearish they’ve been in the past year.

Historically, when bearish sentiment spikes, it tends to mark buying opportunities, and that’s exactly what may be happening now.

Here’s the key takeaway:

Each time sentiment has been this negative over the past year, the market has moved higher afterward.

Why?

- When sentiment is this bearish, it means most bad news is already priced in.

- With so much negativity, it doesn’t take much for the market to surprise to the upside.

Right now, we’re at another critical sentiment extreme, which suggests that despite the bad news, the market may still have room to run.

So, What’s Next?

Markets love to speculate about what the Fed will do next. But at the moment, the data is messy, and the sentiment is so bad… that it’s actually good.

But here’s the big question: Are investors just pricing in too much bad news? Or is the market’s resilience ignoring a real risk?

One thing is certain: Buckle up, because this could be a wild ride.

Schedule a Portfolio Review