How Are We Positioned for the Election?

It’s Election Day, a time when half the country is biting their nails, the other half is eyeing the exits, and everyone with an investment portfolio is wondering, What now?

Every election season, I brace myself for the flood of questions about how we’re “positioned for the election,” as if the market hinges on one person winning or losing. And each time, my answer is the same: we haven’t made a single change based on election predictions.

Why? Because trying to time the market around an election’s outcome is like trying to predict next month’s weather by flipping a coin. Risk management isn’t about guessing what might happen; it’s about tuning out the noise, following the signals, and staying grounded in what actually moves markets. So before you ask, here’s exactly why election outcomes don’t alter our investment strategy and why you shouldn’t lose sleep over them either.

This isn’t one of those generic “stay invested” pieces that urge you to ride out the market no matter what. There are already plenty of articles that tell you to sit tight and hold on. Here, it’s all about taking action when the signals point to elevated risks, and knowing when to ignore the noise.

Proper risk management isn’t about anticipation; it’s about cutting through noise to listen to the signals. We’re not trying to predict outcomes, we’re making adjustments that tip probability in our favor.

But let’s look at what actually causes significant moves. Because it’s rarely elections.

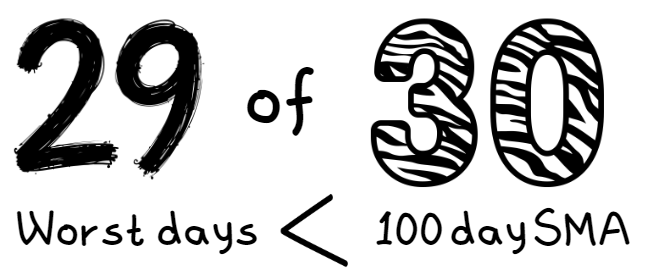

Since September 1989, we’ve tracked the S&P 500’s worst 30 days. Of those, 29 occurred when the index was below the 100-day simple moving average, and 28 were below the 200-day. These returns ranged from -4.54% to -11.98% in a single day.

And here’s the kicker: in my opinion, not one of these worst days was tied to an election. They were all triggered by far more significant events such as the dot-com bubble, the financial crisis, a U.S. credit downgrade, and, of course, a pandemic.

The common thread? Nearly all of them happened when the index was already below the 100-day moving average. Think of the 100-day and 200-day moving averages as the market’s weather forecast. When it’s sunny (prices are above these levels), we stay the course. But when it’s stormy (prices dip below), that’s when we pull out the rain gear.

Historically, while market volatility can increase slightly around Election Day, it typically doesn’t compare to the moves we see during major crises.

Pandemic Volatility

During the pandemic, from March 9, 2020, to March 18, 2020, we witnessed a dizzying stretch of both some of the worst and best days in the market, consecutively:

- 3/9/2020: -7.60%

- 3/10/2020: +4.94%

- 3/11/2020: -4.89%

- 3/12/2020: -9.51%

- 3/13/2020: +9.29%

- 3/16/2020: -11.98%

- 3/17/2020: +6.00%

- 3/18/2020: -5.18%

Each of these returns happened while the index was below both the 100-day and 200-day simple moving averages.

Financial Crisis Volatility

Lehman Brothers collapsed on September 15, 2008. Between then and December 1, 2008, the S&P 500 saw 13 of the worst 30 days in the past 35 years, that’s nearly half in just three months. And again, all of these occurred when the index was below both the 100-day and 200-day moving averages.

Yes, this volatility happened around the 2008 election. But it wasn’t because of who was voted into office; it was because the global financial system was on the brink of collapse.

How Do We Position for an Election?

We don’t.

Instead, we use risk indicators, like the 100-day and 200-day simple moving averages.

The reality is, as long as the S&P 500 has stayed above the 200-day simple moving average (or the 10-month average, as a proxy), downside risk has been relatively mild. If it’s above this level, by definition, it’s in a positive trend.

Currently, the S&P 500 isn’t just above the 200-day and 100-day averages; it’s also above the 50-day average. Does this mean it won’t dip today or tomorrow depending on the election outcome?

I have no clue. And guess what? Neither does anyone else.

Just like every election, we’ve got “experts” left, right, and center tossing predictions like confetti. But remember, noise doesn’t mean insight.

So, despite all the analysis, studying, and guessing from the “experts” about the election outcome, I’m not worried. Frankly, as a portfolio manager, my job is to manage risk and spot opportunity.

As long as broader markets stay above our risk levels, we’ll stay long because the data says the risk-reward is on our side. And no, this time is not different, those last 35 years included some of the best and worst markets in history.

So, remember this: When you ask me during the 2028 elections how we’re positioned, I’m just going to send you back to this post. Or better yet, let’s focus on the real signals instead.

And if you’re wondering where the real risks lie right now, stay tuned. In my next post, I’ll break down why we might be in the midst of a bubble and how today’s elevated risk levels echo some of the most volatile times in recent history. Hit subscribe to stay informed because when it comes to managing risk, timing is everything.

Meet with us

This is where we believe a knowledgeable advisor becomes important. They not only monitor these evolving trends but also interpret how they intersect with your financial goals. By staying ahead of these factors, an advisor may help pinpoint the best moments to act - whether it’s refinancing, managing debt, or adjusting your investment strategy for stability and growth. If you are curious about how a financial advisor could help you with your personal situation, please send me a note.