If credit spreads don’t collapse soon, the market just might

Stocks may be bouncing, but the real signal lies in credit spreads, if this chart keeps rising, the market’s next move could be sharply lower

Friday’s rally felt great, but was it the start of a real recovery or just a short-lived bounce? If you’re only watching stock prices, we think you’re missing the bigger picture. The bond market, the so-called "smart money," is sending a message. And it’s coming from one key chart that could decide what happens next.

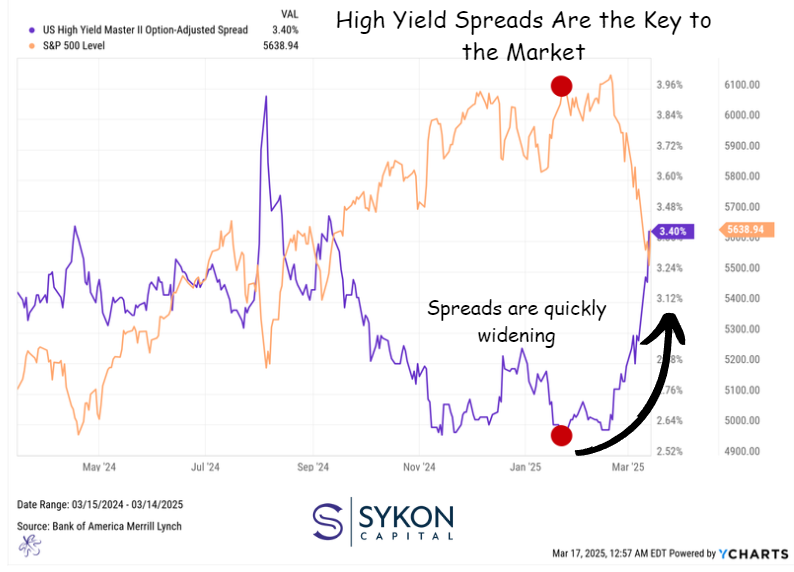

Credit Spreads Are Sending a Warning

The option-adjusted high-yield credit spread hit a low of 259 basis points on January 22, 2025, right as the S&P 500 was making new all-time highs. Fast forward two months, and spreads have been widening rapidly while the S&P 500 has dropped nearly 10% from its peak.

When the S&P 500 set a new record at 6,144 on February 19, high-yield credit spreads failed to confirm the move, instead making a higher low. That’s what’s known as a bearish divergence, a sign that the rally may not have had broad support.

Now, credit spreads are breaking out of a downtrend that began in July 2022. If they don’t reverse soon, history suggests equities have more downside ahead before a true recovery can take hold.

Why does this matter? Because when credit spreads widen, it historically means investors are demanding more compensation to hold risky debt. That’s usually a sign of increasing stress in financial markets and a warning that stocks may not be out of the woods yet.

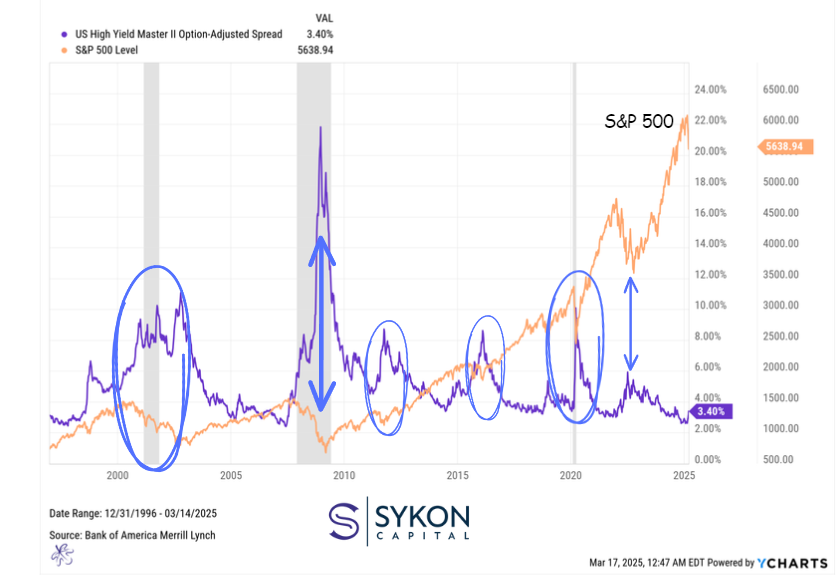

How High Can Credit Spreads Go?

On a relative basis, credit spreads remain historically tight at 340 basis points. But when markets correct, spreads typically widen to 600 basis points or more.

For context:

- Dot-com bubble: Spreads hit 1,000 basis points

- Financial crisis: Spreads surged to 2,200 basis points

- COVID crash: Spreads spiked to just over 1,000 basis points

If history is a guide, we think credit spreads still have room to move much higher.

What This Means for Markets

What should investors do? If spreads keep climbing, it suggests more downside for stocks before a recovery can take hold. If they start tightening again, equities might have a shot at stabilizing.

Traditionally the bond market has been considered the smart money. So set your expectations accordingly.