Navigating Market Volatility: The Risks of Buying the Dip

With market dips being touted as buying opportunities, is now the time to invest? Understand the underlying risks and why patience is key in today's volatile market.

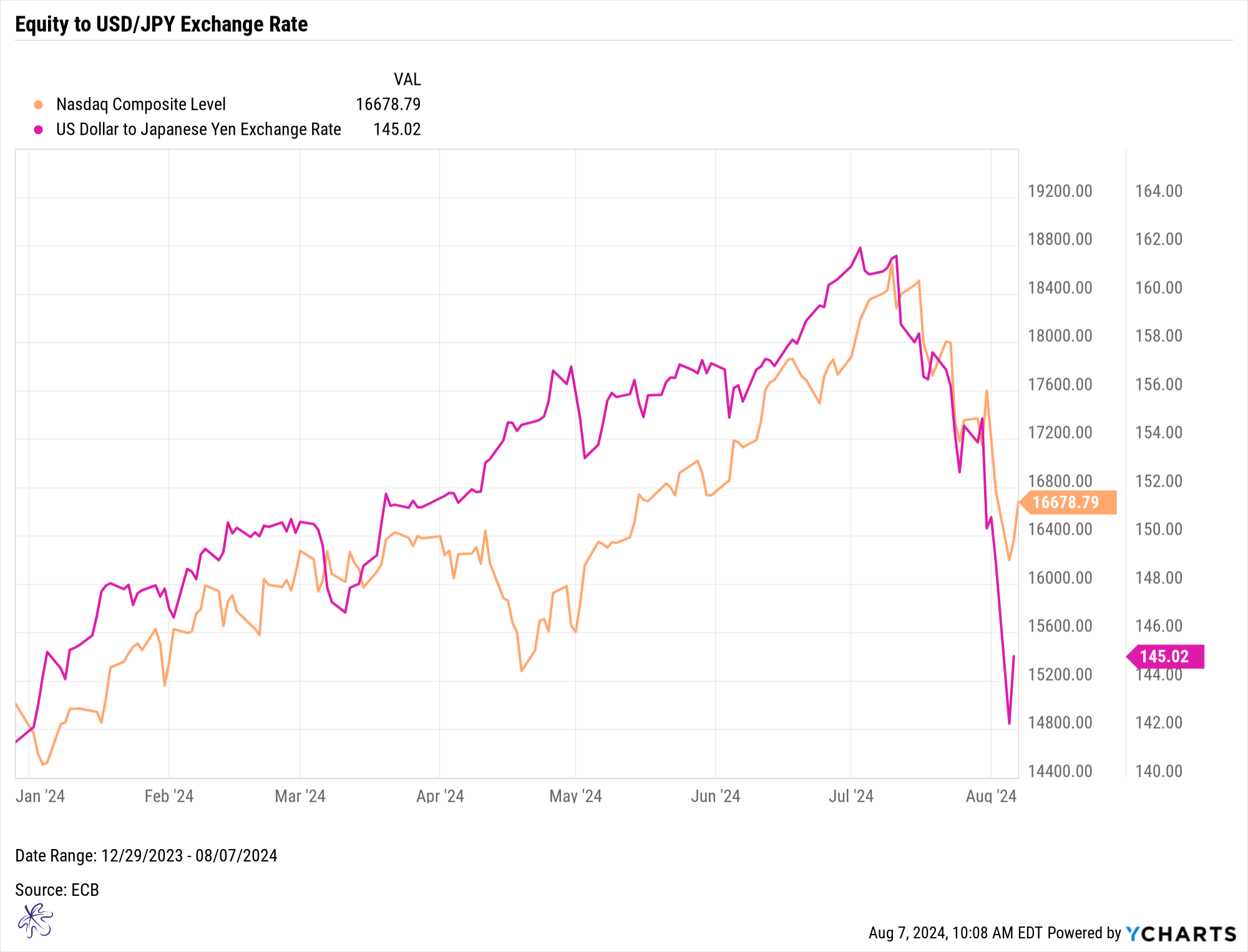

The correlation between the NASDAQ Composite Index and the USD/JPY exchange rate is very high right now, as each of these charts is mirroring each other almost step for step.

Given this strong correlation, we need to dig deeper into what these charts are telling us and what we should look for to determine potential opportunities moving forward.

Source: StockCharts.com

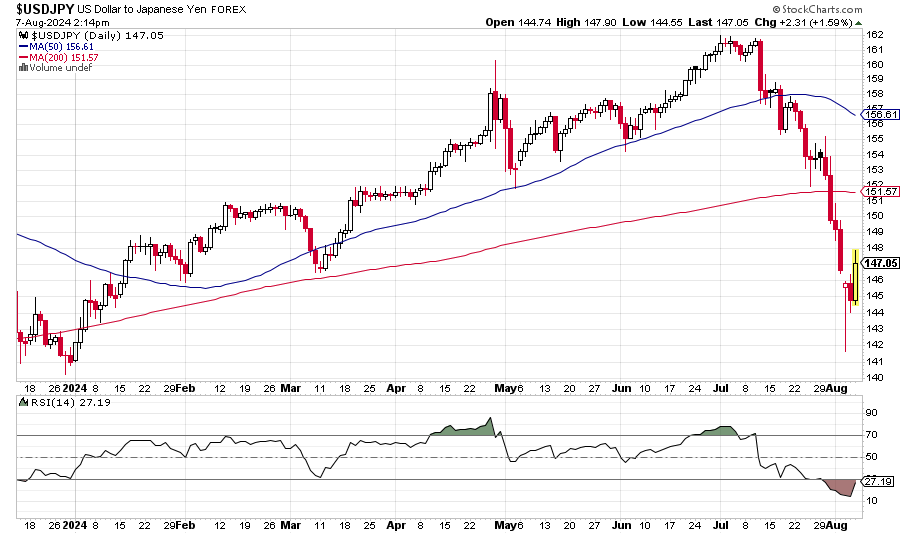

On Monday, the USD/JPY exchange rate plummeted so far that the daily RSI was pushed to a closing low of 12.8. This indicates one of the most extreme oversold levels observed on a closing basis.

In response to these extreme oversold levels, the exchange rate is bouncing off the lows but remains below the oversold RSI level of 30.

Source: StockCharts.com

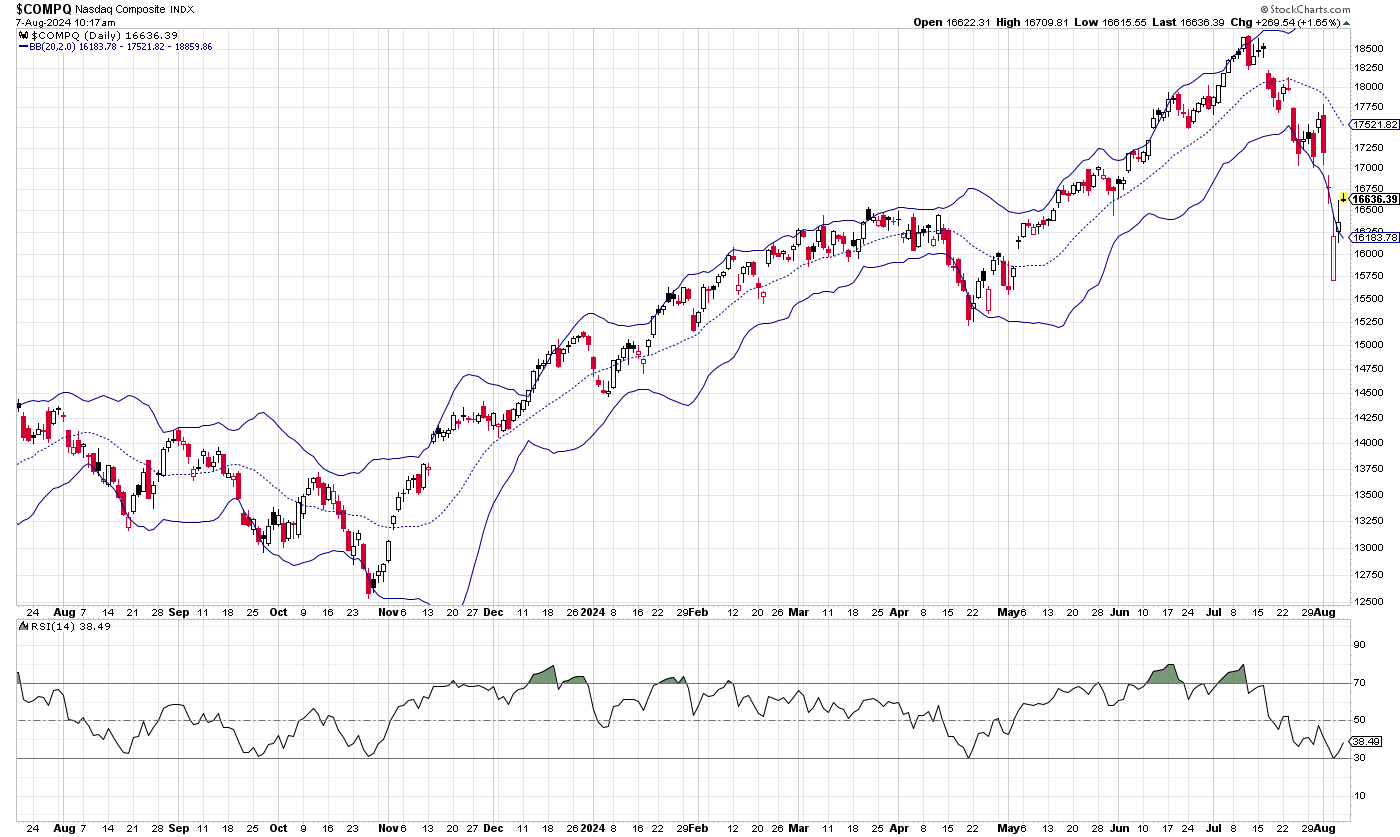

Similarly, the NASDAQ Composite Index is also bouncing off the 30 RSI level. In a previous blog post, we highlighted the probability of this pattern occurring ("Is the Unwind of the YEN Carry Trade the Reason for the Market Volatility?”).

In August and September of 2023, we saw a similar bounce that was met with selling pressure, resulting in lower lows. However, the bounces in October 2023 and April 2024 followed through to make new highs.

So, how can we distinguish between a buying opportunity and a bull trap that may reverse lower? The first rule is patience. Avoid trying to time the bottom. Let the market find its direction and then take advantage of the momentum. For example, in August and September 2023, the index ran back up to the upper Bollinger Band and failed. In contrast, in November 2023 and May 2024, the index broke above the upper Bollinger Band and rode it to new highs.

S&P500 Index Forward PE Ratios

Source: Bloomberg

I can already hear the pundits screaming that you will miss the buying opportunity as the market is now on sale. But is it really? The PE ratio of the S&P 500 going back to 1990 shows that even with the current market sell-off, the PE ratio is at 19.85. This is one of the highest PE ratios for the index in the past 35 years. Considering the average PE ratio over that time is 16.46, the S&P 500 index is far from being “on sale”. Even with a drop to the average level, the market would only be considered fairly valued, at best.

Patience and Informed Decision-Making

It's crucial to anchor your decisions in thorough analysis and avoid being swayed by short-term market movements or media hype. Anchoring bias can lead to poor decision-making if you're fixated on specific price points or past performance.

Understanding your specific situation, properly analyzing your time frame, and comprehending the risks relative to your lifestyle are essential steps. Don’t just react—plan. Evaluate your investment strategy with these considerations in mind. For personalized guidance, contact us to help you navigate these turbulent times and align your investments with your long-term goals.