”Sentiment's low; buy equities now” – here’s what’s WRONG with that approach

Investor sentiment is at historic bearish levels, leading the media and industry voices to decry, “It’s time to buy equities!” Not so fast! With the market at near all-time highs, is this really the ultimate buying opportunity? Or, is it a sign that something is about to break?

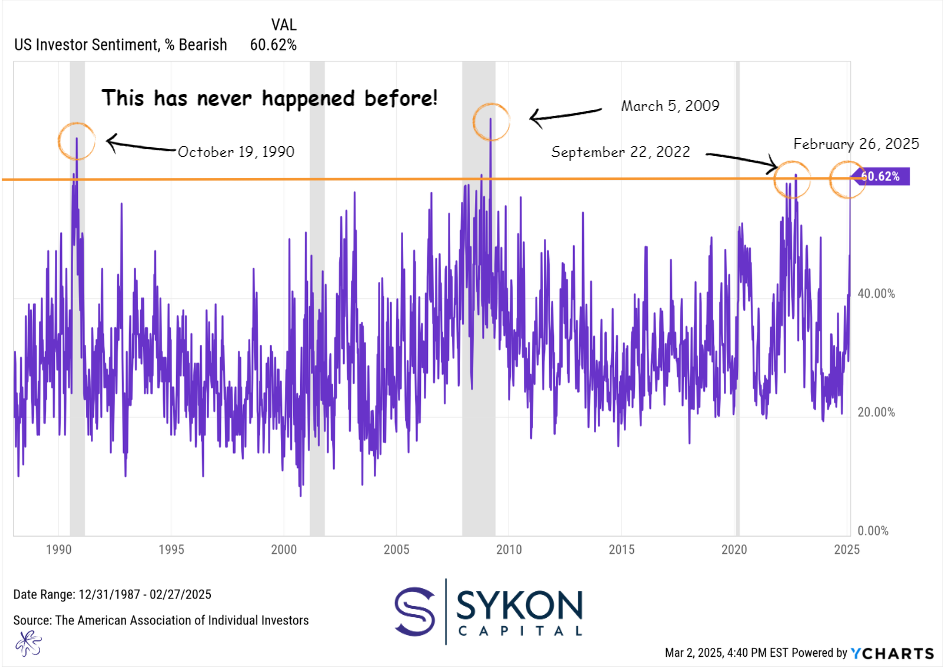

We have never seen a level of pessimism this extreme within 5% of a stock market high.

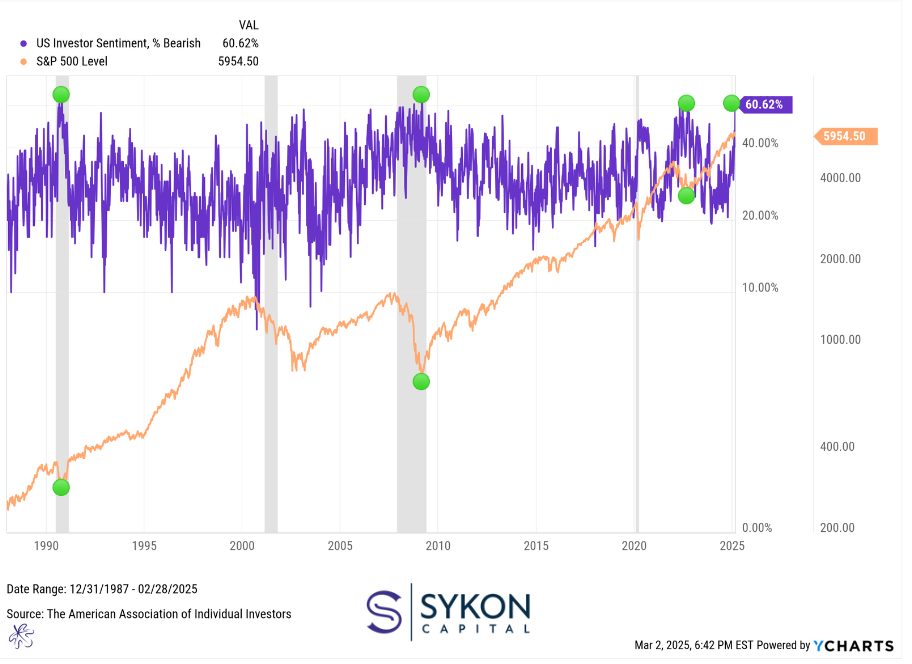

Investor sentiment hit 60.6% this past week, according to the AAII Sentiment Survey. For context, the historical average for bearish sentiment is around 30.5%, making this reading nearly double the norm. Such extreme pessimism is typically seen during economic crises, not near market highs. (Source: AAII). This is only the fourth time in the history of the survey (since 1987) that bearish sentiment has exceeded 60%. But what makes this moment unique is that it is the first time ever that such extreme pessimism has occurred within such close proximity of an all-time high on the S&P 500.

Historical Context

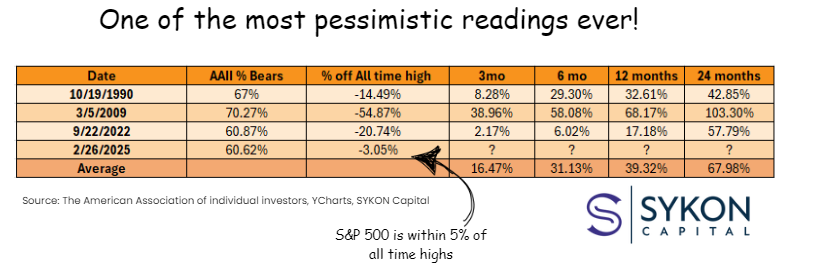

The last three times bearish sentiment was this high, the S&P 500 was deep in bear market territory. Think back to March 5, 2009 when the global economy was in freefall and many believed we were on the brink of financial collapse. It was just days before the Federal Reserve stepped in to bail out the system.

Yet, history tells us something interesting. I charted forward-looking returns over the next 3, 6, 12, and 24 months, and the results were stunning. The market rebounded strongly in each of those cases, proving that extreme bearish sentiment can set the stage for incredible buying opportunities.

What This Means for Investors

We have seen this pattern before. In 1990 and 2009, at the depths of recessions, extreme pessimism marked generational buying opportunities. The market eventually surged higher, rewarding those who took advantage of the fear-driven selloffs. And yet, despite history's lessons, the question lingers. Is this time different?

But What If This Time Is Different?

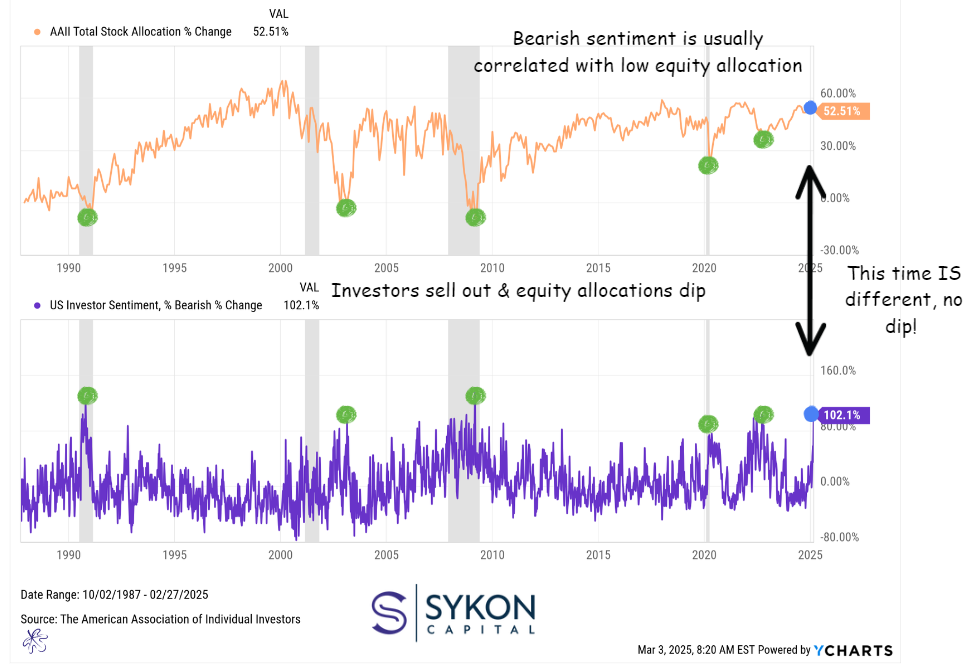

There is a disconnect in the market that is hard to ignore. Investors are overwhelmingly bearish despite their historically high allocation to equities. Typically, extreme bearish sentiment corresponds with investors holding significantly lower levels of equity, ready to redeploy cash into equity markets. This time, however, investors may be tapped out, as equity allocations are near peak levels by historical standards.

This raises a key concern: What if investor sentiment itself creates a negative feedback loop? If bearishness leads to a gradual reduction in equity allocations, this could reinforce broader economic caution and contribute to market weakness.

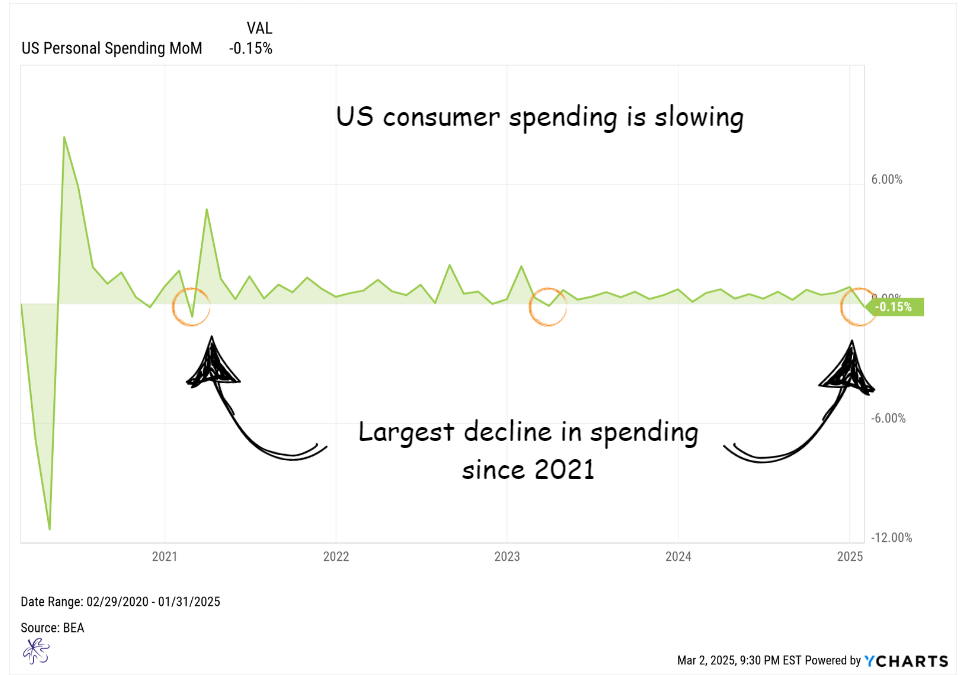

While shifts in investor equity allocations may take time, consumer spending is already providing real-time insights into economic sentiment.

According to recent data, U.S. consumer spending declined by 0.2% in January, marking the first decrease since March 2023 and the largest drop in nearly four years. (Source: Reuters), marking a shift in sentiment and behavior. While inflation remains sticky, the decline in spending suggests that consumers are tightening their belts. Historically, consumer spending is one of the primary drivers of economic growth. When people start cutting back, it can create a negative feedback loop, reduced spending leads to slower economic growth, which fuels more pessimism, causing consumers to become even more cautious.

The Negative Feedback Loop in Motion

This shift in spending is not just a blip. Over the past few months, we have seen increasing evidence that households are becoming more cautious. Higher borrowing costs, dwindling pandemic-era savings, and persistent inflation have all contributed to a more conservative approach to spending. If this trend continues, the ripple effects could extend beyond retail and consumer goods, hitting corporate earnings and, ultimately, the labor market.

Major retailers like Walmart and Target have already flagged weaker consumer demand, particularly in discretionary spending categories. Walmart's most recent earnings call noted slowing sales growth in higher-margin categories like electronics and apparel, while Target reported a dip in customer traffic. (Source: MarketWatch).

A decline in spending leads to lower revenues for businesses, which in turn may lead to cost-cutting measures such as layoffs or hiring freezes. This, in turn, reduces disposable income, reinforcing the cycle of weaker spending and growing economic uncertainty.

Investor Sentiment and Economic Reality

At first glance, the disconnect between market highs and bearish sentiment seems perplexing, but when viewed through the lens of declining consumer spending, it starts to make sense. Investors may not be reacting to the stock market’s performance today but rather to concerns about what happens next. If consumers pull back further, corporate profits could come under pressure, leading to valuation resets and potential market volatility. This is even more concerning with valuations are at historicaly expensive levels.

More Questions Than Answers

Unfortunately, I am left with more questions than answers. But if history has taught us anything, it is that market extremes, whether in sentiment or spending patterns, rarely persist forever. Investors should keep a close eye on consumer spending trends, corporate earnings, and employment data to gauge whether this is a temporary shift or the beginning of a broader economic slowdown.

One key indicator to watch will be corporate guidance in upcoming earnings reports. If more companies start revising their revenue expectations downward due to weaker consumer demand, it could signal that the slowdown is more than temporary. Additionally, changes in employment data, particularly in consumer-facing sectors like retail and hospitality, may provide further clues about the broader economic impact.

Because maybe, just maybe, this time is different but not in the way everyone thinks it is.