The Everything Bubble: Why International Equities Could Be the Next Big Opportunity

Amid all the buzz about the Everything Bubble, one overlooked opportunity stands out. While domestic equities have dominated for years, the extreme gap between U.S. and international markets suggests a shift may be on the horizon. Are you ready to pivot and seize the next big opportunity?

Is It Time to Reconsider International Equities?

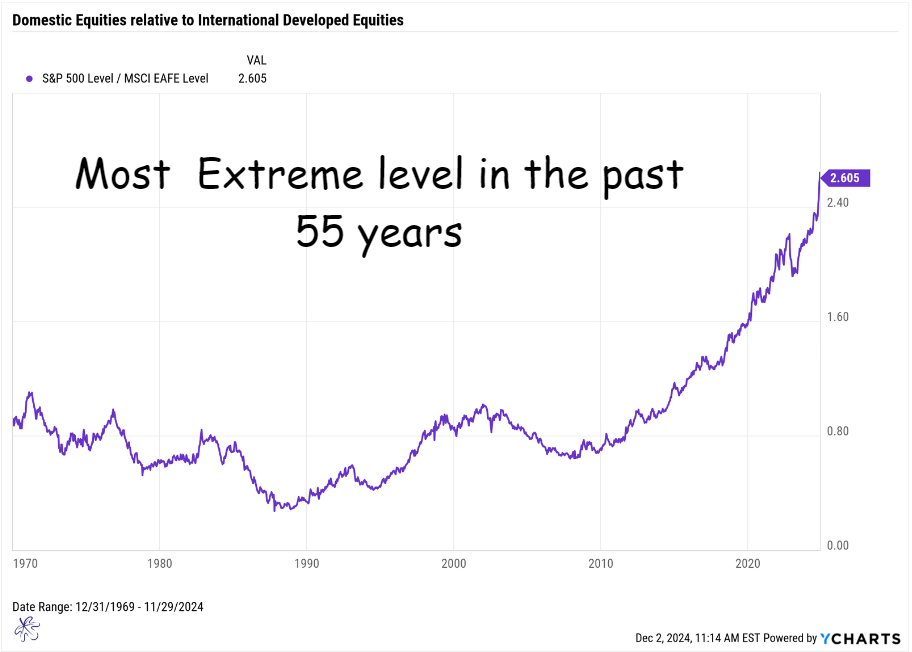

The ratio of the S&P 500 Index (domestic stocks) to the MSCI EAFE (developed international stocks) is now at its highest level in 55 years, essentially since the inception of the MSCI EAFE. This historical extreme reflects a dramatic outperformance of domestic equities relative to their international counterparts, a trend that has dominated for over a decade.

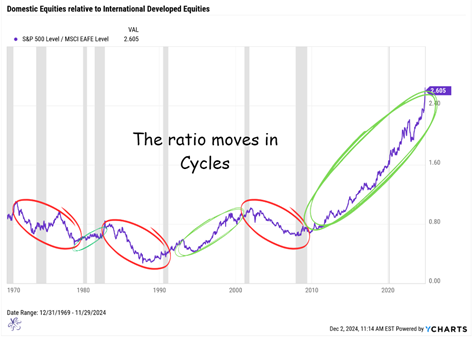

For the past 15 years, allocating to international equities has been a tough case to make. U.S. stocks have consistently outpaced international indices, leaving many investors questioning the need for international exposure. However, if history teaches us anything, it's that markets move in cycles. Leadership between domestic and international equities tends to shift, and it's highly unlikely that the current trend of domestic outperformance will continue indefinitely.

The Cyclical Nature of Market

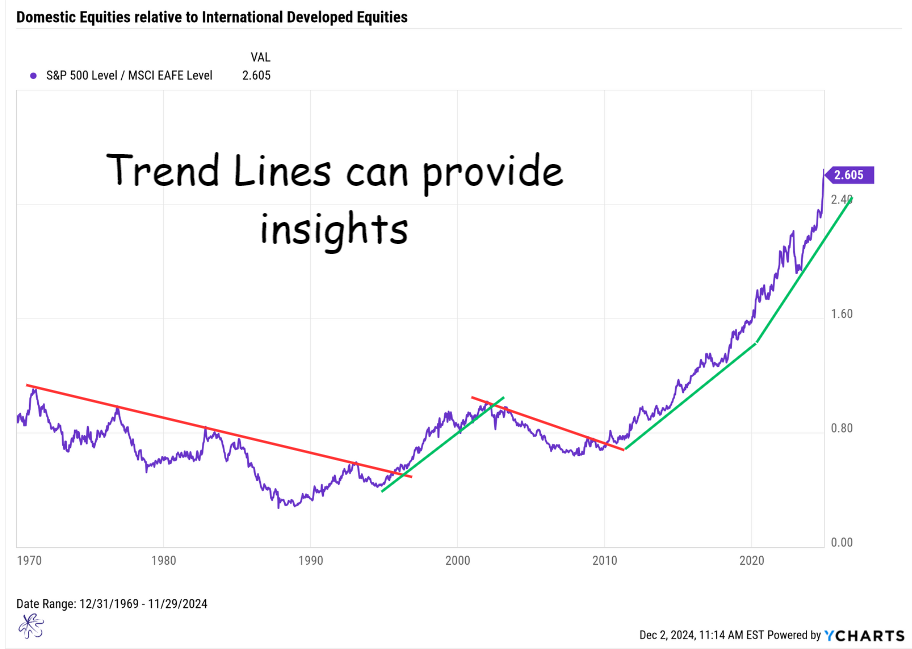

Over the long term, we’ve seen trends like this reverse multiple times. While our strategies allow for significant allocations to international equities, we've leaned heavily toward domestic stocks recently due to the unfavorable risk-reward ratio for international investments.

But here's where the tide could turn: using cross-sectional momentum analysis, we can detect shifts in market preferences early in the transition. This method allows us to identify when trends favor international over domestic equities and reweight portfolios accordingly. By significantly adjusting exposure in favor of assets showing early signs of preference, we can align portfolios with prevailing market dynamics rather than lagging trends.

This flexibility, we believe, is a key advantage of our dynamic asset allocation process—it helps ensure that we are positioned to potentially capitalize on changes in market leadership as they emerge.

Why Static Allocation Isn’t the Answer

A common refrain seen on social media and in forums is, “Just buy the S&P 500 index ETF, what else do you need?” While this advice reflects a strong home bias, it risks missing out on significant opportunities. Over time, sticking solely to U.S. equities could mean forgoing substantial returns from international markets.

However, maintaining a static allocation to international equities isn’t ideal either. During prolonged periods of domestic outperformance, holding international equities can drag portfolio returns. We see the key as flexibility, adapting your allocation dynamically to reflect changing market conditions.

Key Takeaways

1. Domestic equities may be in bubble territory.

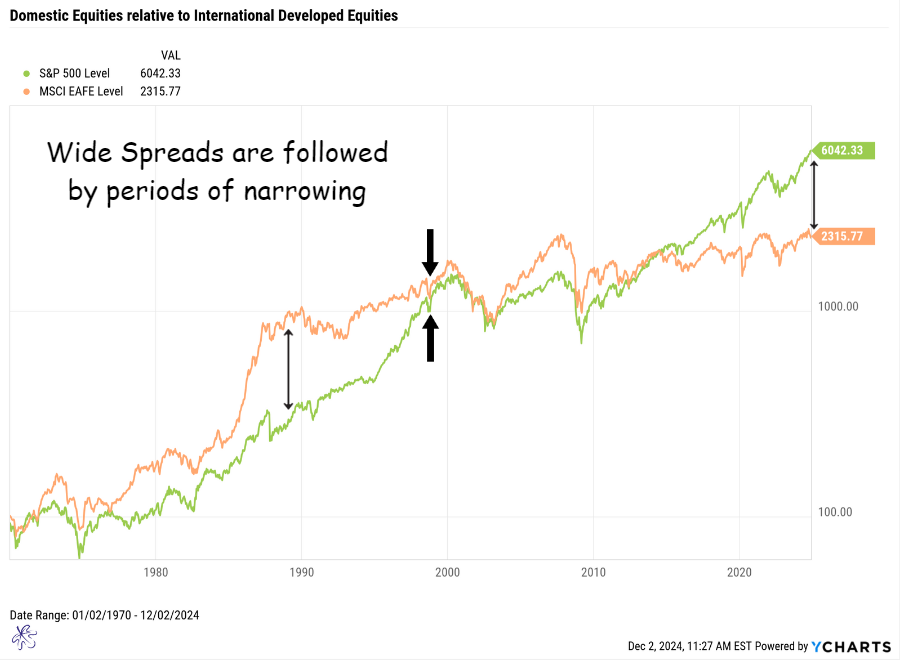

The extreme ratio of domestic to international equities suggests that U.S. stocks could be overextended. Elevated valuations in certain sectors, such as technology, amplify this concern.

2. The "Everything Bubble" narrative may be skewed by home bias.

While domestic equities dominate headlines, international markets have yet to recover their pre-Financial Crisis highs. This divergence may offer a more favorable risk-reward profile for international equities.

3. History often repeats itself.

Leadership in markets tends to rotate over time. Based on historical patterns, there is a high probability that the current ratio will reverse in favor of international equities.

The Case for Dynamic Allocation

Static strategies often fail to capture opportunities during major market shifts. By contrast, a dynamic approach leveraging cross-sectional momentum can adapt portfolios to evolving trends. Cross-sectional momentum evaluates the relative strength of different asset classes, allowing us to detect early signs of shifts in market preferences. This enables us to reweight portfolios in favor of the assets gaining momentum, positioning for outperformance while minimizing drag.

For example, as trends favor international equities, we can allocate a greater proportion of assets to this segment before the broader market consensus shifts. This approach is not just reactive but proactive, aiming to capture leadership transitions as they develop.

Final Thoughts

Understanding and adapting to market cycles we think, is critical for long-term success. While domestic equities have been the clear winner for the past 15 years, the extreme outperformance suggests that the pendulum may soon swing back toward international markets. A flexible, dynamic allocation strategy, such as leveraging cross-sectional momentum, helps ensure that your portfolio can potentially capitalize on these shifts while staying aligned with the changing global landscape.

Now is the time to evaluate your portfolio’s global allocation. Are you positioned to take advantage of potential opportunities in international equities? If not, it may be time to consider a more dynamic approach to investing.