The Impact of Potential FOMC Rate Cuts on the Economy

Will the Fed Cut Rates in September? The market is confident, but what if the FOMC doesn't follow through? Discover the potential impacts on the economy and housing market in our latest analysis.

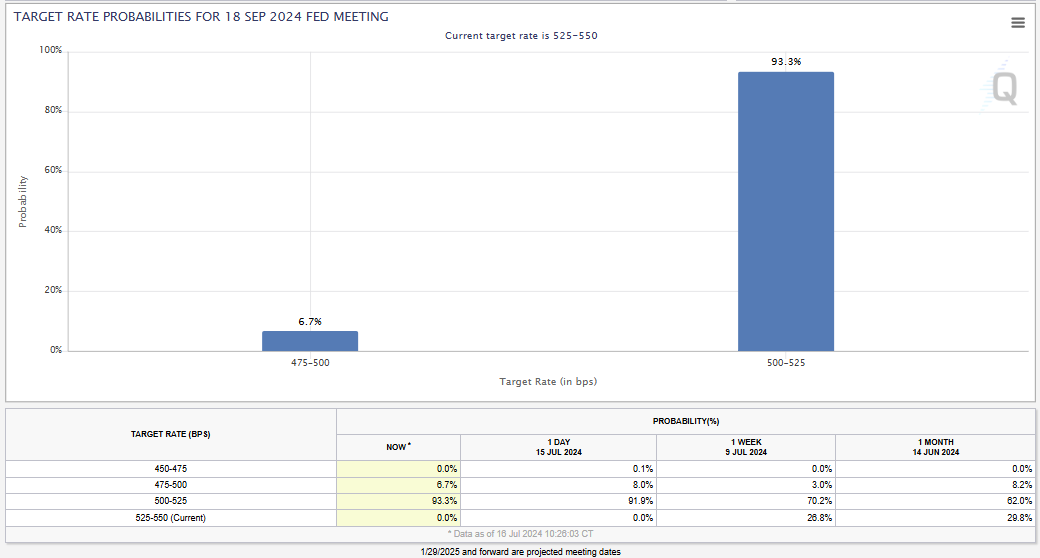

Figure 1 - Change in probabilities of a FOMC rate cut in September over the last 30 days

Source: CME Fed Watch Tool

Current Market Expectations and Rate Cut Probabilities

The market is currently placing a 100% probability that the Federal Reserve will cut rates in September. But what happens if the FOMC doesn’t cut rates? Just one month ago, market participants placed a 29.8% probability that the FOMC would hold rates at the current levels at the September meeting (Fig 1). Today, this probability is 0%. There is a 93.3% probability that the FOMC will cut by 25 basis points and a 6.7% probability that they will cut by 50 basis points in September.

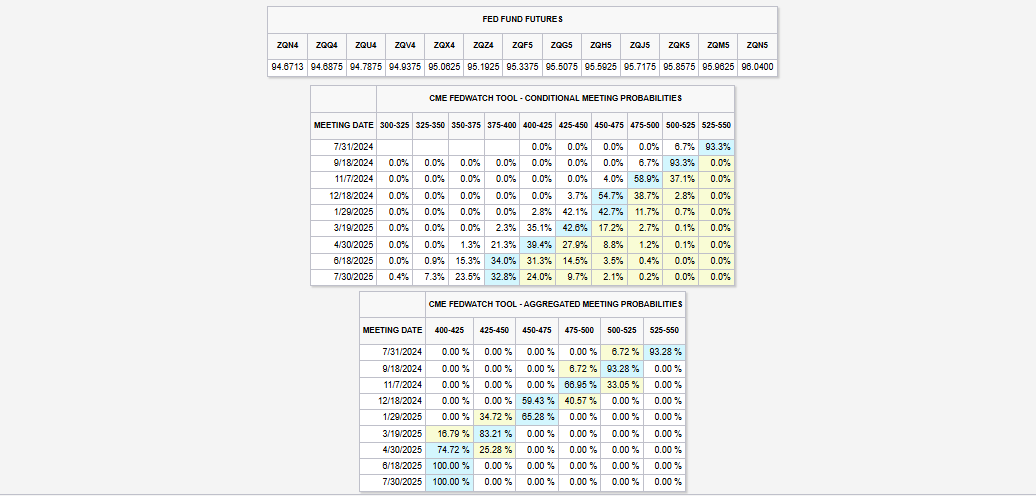

Source: CME Group Fed Watch Tool

Figure 2 – Probabilities of FOMC target rate over the next 12 months.

Shifts in Probabilities and Economic Indicators

The market is calling for a rather aggressive rate-cutting cycle, with the FOMC expected to cut about 25 basis points every other meeting over the next year, reaching a terminal rate of about 375 basis points by next summer. This would represent a 150 basis point rate cut from where we are today.

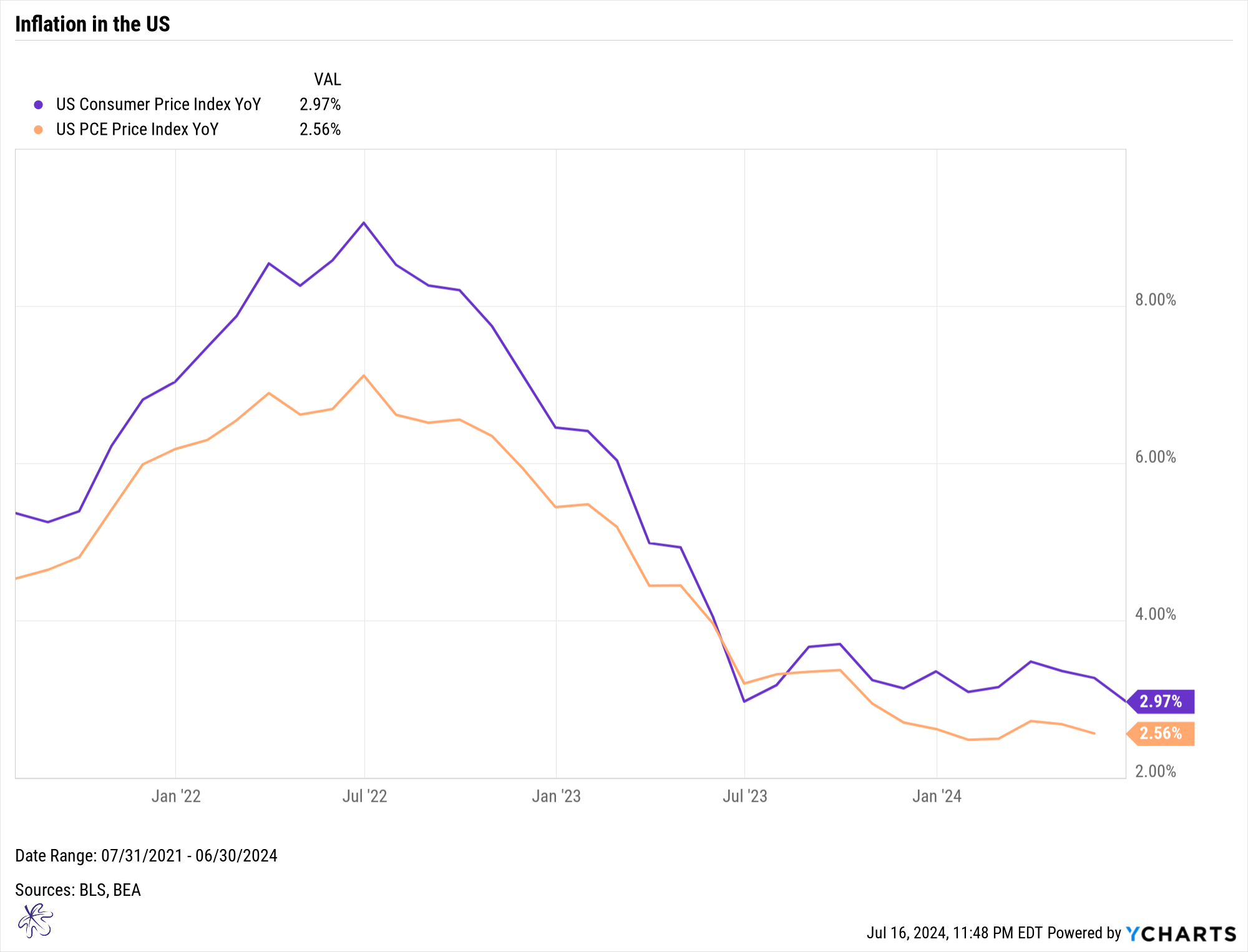

Figure 3 - Month over month change in CPI and PCE.

Probabilities of a rate cut have shifted significantly due to recent economic data: the month-over-month change in the Personal Consumption Expenditures (PCE) index is flat, while the month-over-month change in the Consumer Price Index (CPI) is negative for the first time since the pandemic recession (Fig 3).

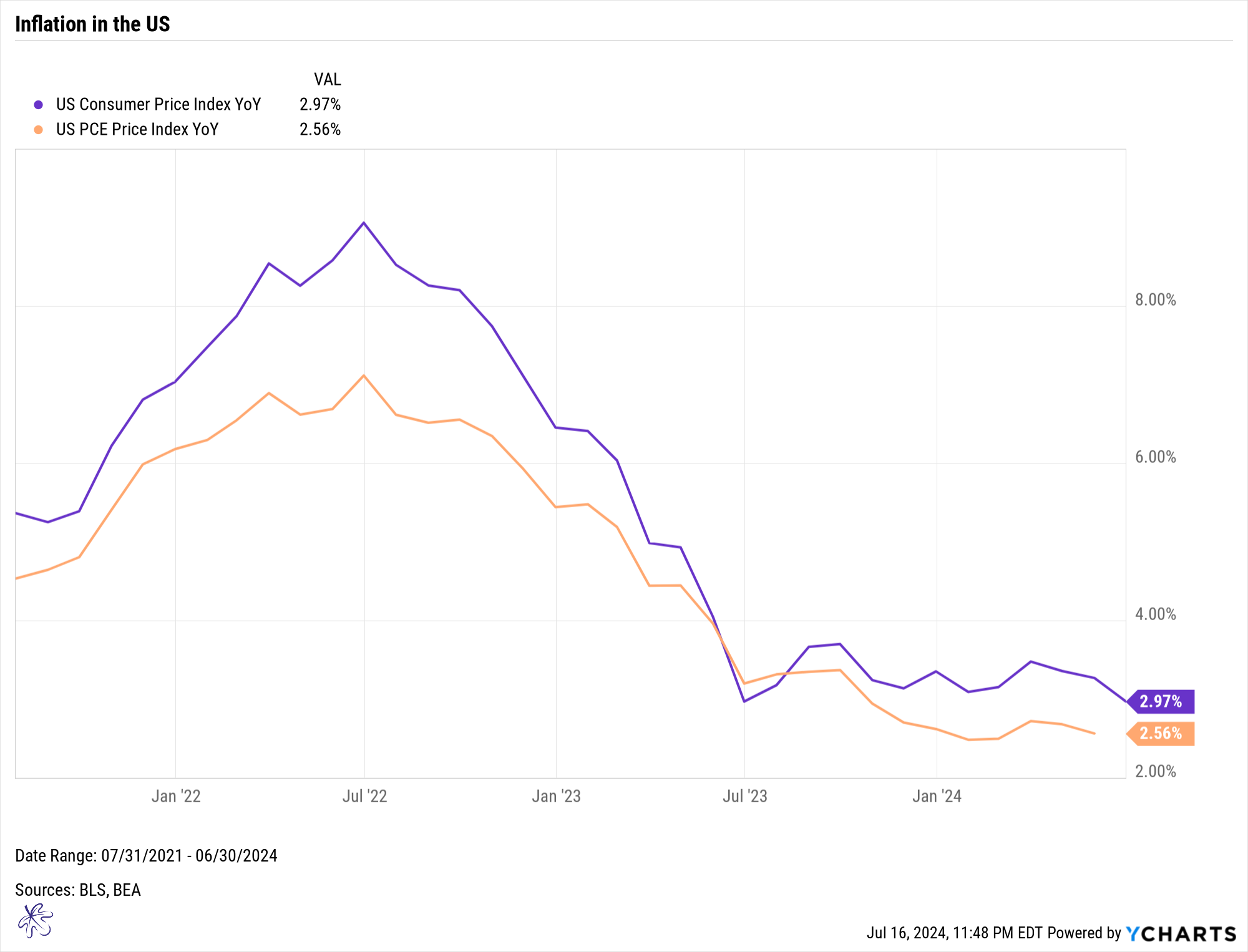

Figure 4 - Year over year change in CPI and PCE.

Despite these changes, year-over-year inflation data remains well above the FOMC’s target of 2%. Currently, CPI is at 2.97% and PCE is at 2.56% (Fig 4).

On a superficial level it appears that this may be close enough to the FOMCs target inflation, but we can’t look at what has happened in the past. We need to look at the implication of a rate cut today.

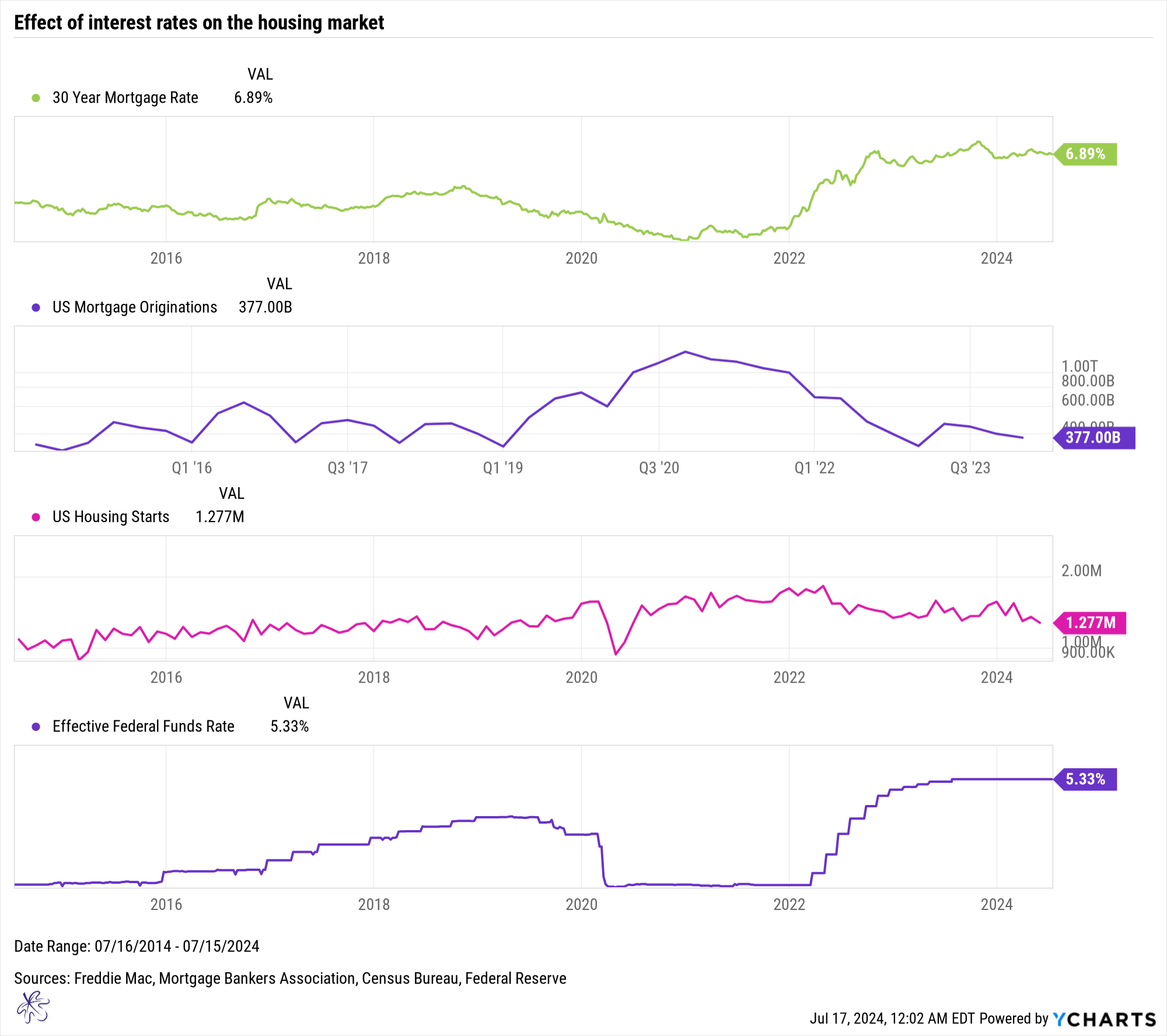

Figure 5 - The relationship between FOMC rates, 30 yr mortgage rate, mortgage originations and Housing starts

Analyzing the Relationship Between Interest Rates and Housing

The bottom chart in purple represents the effective Fed funds rate. As this rate increases or decreases, it drives the broader trend in 30-year mortgage rates, indicated by the green line. As mortgage rates drop, mortgage origination increases.

Robust increases in mortgage origination are also correlated with increased housing starts. This can be seen in the provided chart, where housing starts began significantly increasing from 2019 through 2022. The persistently higher rates at present have had the opposite impact, as mortgage origination and housing starts have been stifled. Housing starts are often considered an important leading indicator of the economy.

Understanding the relationship between interest rates and the housing market is essential because if the FOMC begins an aggressive rate-cutting cycle, there is a high probability that the housing market will turn higher, potentially boosting the economy and causing inflationary pressures to reemerge.

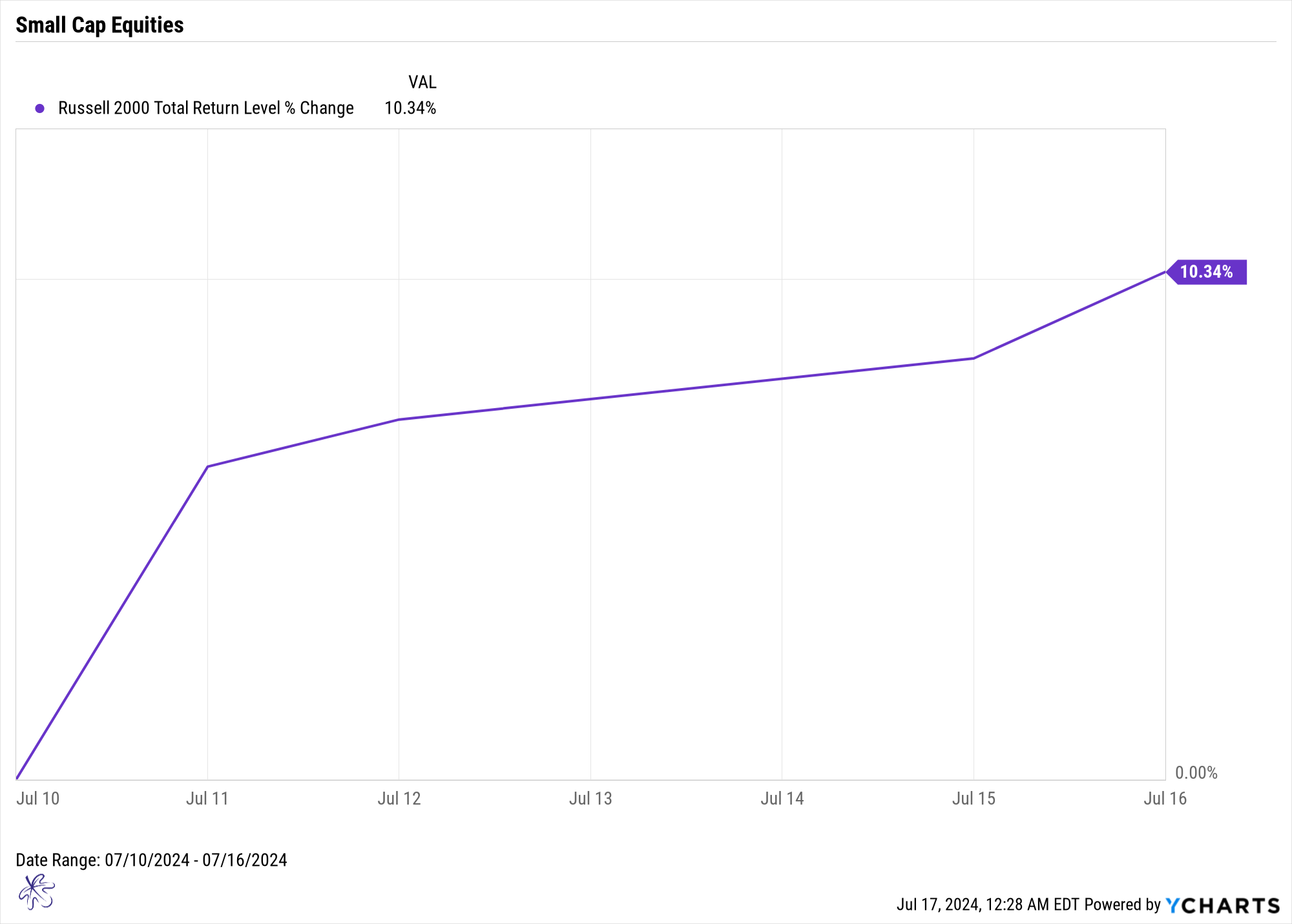

Figure 6 – Performance of the Russell 2000 (small cap) index over the previous 5 trading days.

Market Risks and Investor Considerations

Market risk arises when reality differs from market expectations. Sometimes those expectations are negative, and the market surprises to the upside. Think about March of 2009 or April of 2020. This may be one of those times when everyone is expecting a rate cut, and the market has rallied significantly on the back of this. The Russell 2000 Index is up over 10% in the last five trading days as investors continue to place an increased probability of a rate cut. But what happens if the FOMC does not cut or the sentiment on interest policy suddenly reverses? Stocks could quickly give back these gains and potentially more.

On the other hand, if the FOMC does cut rates, what is the upside potential for the markets given there is already a 100% probability of a cut? Statistically, the probability of a cut cannot get any better than 100%.

So, ask yourself, are you okay with being one data point away from the market shifting away from perceived certainty and turning significant gains into potentially substantial losses? If the answer is not a resounding yes, it may be time to consider tweaking your portfolio asset allocation. These tactical reallocations are something that we handle for our SYKON clients.

Looking Ahead: Employment Data and Future Rate Cuts

In the coming posts, I will delve deeper into the implications of recent employment data and explore whether we actually want the FOMC to cut rates. The anticipated positive implications may not materialize as the market expects.

Stay Informed and Engaged

For more detailed analysis and updates, subscribe to our blog and join our newsletter. Follow us on social media to stay informed about the latest economic developments and insights