Three Fed rate cuts and still no relief to consumers

Despite three Fed rate cuts, borrowing costs are climbing. Will there be any relief to your wallet in 2025?

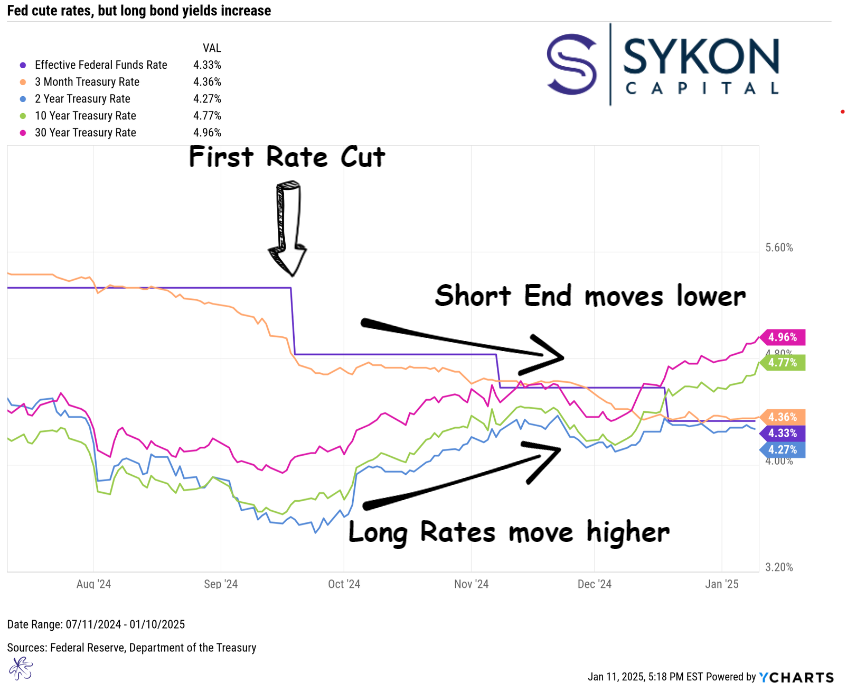

Three rate cuts, 100 basis points, and yet borrowing costs are still climbing. If you’ve been expecting the Federal Reserve’s actions to bring relief to your wallet, think again. Instead of easing financial pressures, Treasury yields have surged, pushing mortgage rates to multi-month highs and making it more expensive for consumers and businesses to borrow.

The 10-year Treasury yield, a key driver of mortgage rates, hit a low of 3.63% in September but has since soared to 4.77%. Meanwhile, the 30-year Treasury yield is nearing 5%, raising questions about whether inflation is sticking around longer than we’d hoped and what that means for both your finances and the broader economy.

CPI in Focus: What to Watch This Week

With Friday’s payroll data coming in much higher than expected, and causing treasury yields to move even higher on anticipation of even less Fed rate cuts, all eyes will turn to the Consumer Price Index (CPI) release on Wednesday, January 15, at 8:30 AM. This critical data point will offer insights into whether the Federal Reserve is likely to continue cutting rates or hold them steady for an extended period.

The market is anticipating a year-over-year CPI increase of 2.9%, up from the previous reading of 2.7%. If the number comes in lower than expected, it could be seen as a positive sign, opening the door for additional rate cuts. However, a higher-than-expected CPI might rattle markets, leading to fears that the Fed will pause rate cuts…or worse, consider raising rates again to combat persistent inflation.

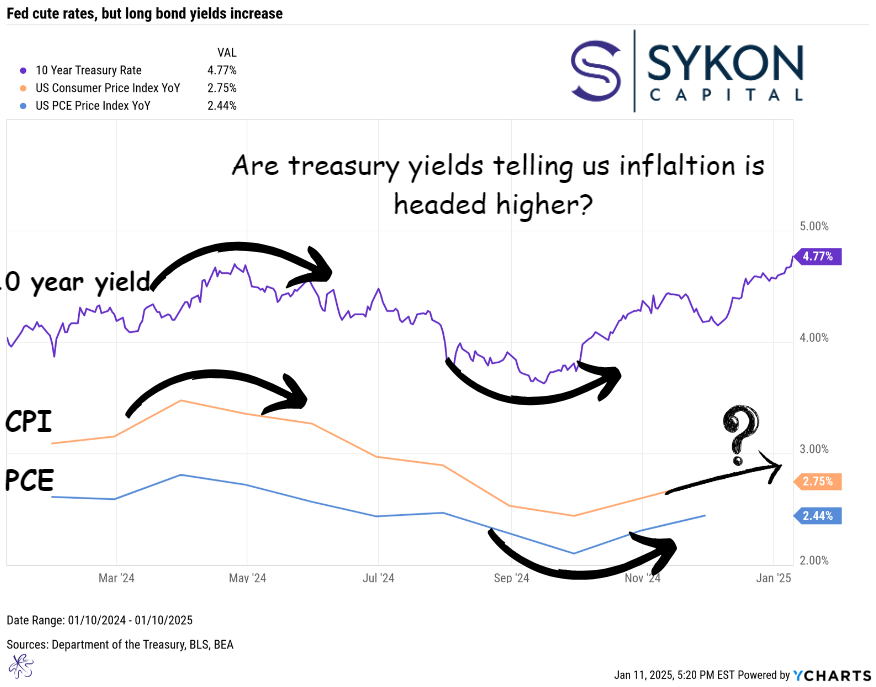

What Treasury Yields Are Telling Us About Inflation

The recent rise in Treasury yields could be sending a warning: higher inflation may be more entrenched than many had hoped. Historically, Treasury yields have served as a reliable leading indicator for inflation metrics like CPI and Personal Consumption Expenditures (PCE).

The graph above highlights how closely the year-over-year changes in CPI and PCE track with the 10-year Treasury yield. When Treasury yields move lower or higher, it often signals changes in inflationary trends ahead of the data itself.

This week’s CPI report will be pivotal. If inflation remains elevated or accelerates, it could signal that we’re in for a prolonged period of higher borrowing costs and potential reacceleration of increasing prices.

How to Avoid the Media Hype and Stay Grounded

The media will undoubtedly hype the CPI report on Monday and Tuesday, building suspense for the Wednesday release. It’s human nature to get caught up in dramatic headlines and speculative predictions. However, as investors, we need to avoid emotional overreactions.

Rather than speculating, take this opportunity to step back and evaluate your financial position. Review your portfolio to ensure it’s resilient to potential changes in rates or inflation. Focus on long-term strategies rather than short-term noise.

The Bottom Line

Treasury yields, inflation data, and rate cuts may seem like abstract concepts, but their effects are anything but theoretical. They ripple through every aspect of our financial lives, from the cost of mortgages to the stability of investment portfolios.

As we approach a pivotal moment in the economic cycle, the key isn’t to predict the future, it’s to prepare for it. The signals are there if we listen. Stay disciplined, adapt to the data, and focus on strategies that align with your long-term goals.

We’ll dive deeper into these themes and more during the 2025 Market Outlook Webinar on January 23 at 11:30am ET. Make sure to reserve your spot today and join the conversation that could help shape your financial strategy for the year ahead.

Register for the Webinar here: 2025 Outlook Webinar Registration