What's Going On with Long-Term Bond Interest Rates?

I recently received this question: “On September 16, the 10-year interest rate was 3.6%. Today, it's 4.2%. That’s a significant increase in less than two months, especially since short-term rates, which the Fed has more control over, are still expected to decline within the next year. What’s going on?”

With long-term bond yields surging, you might be wondering what’s driving this unexpected trend and what it means for your financial plans. Here’s a breakdown of what’s happening and why it matters.

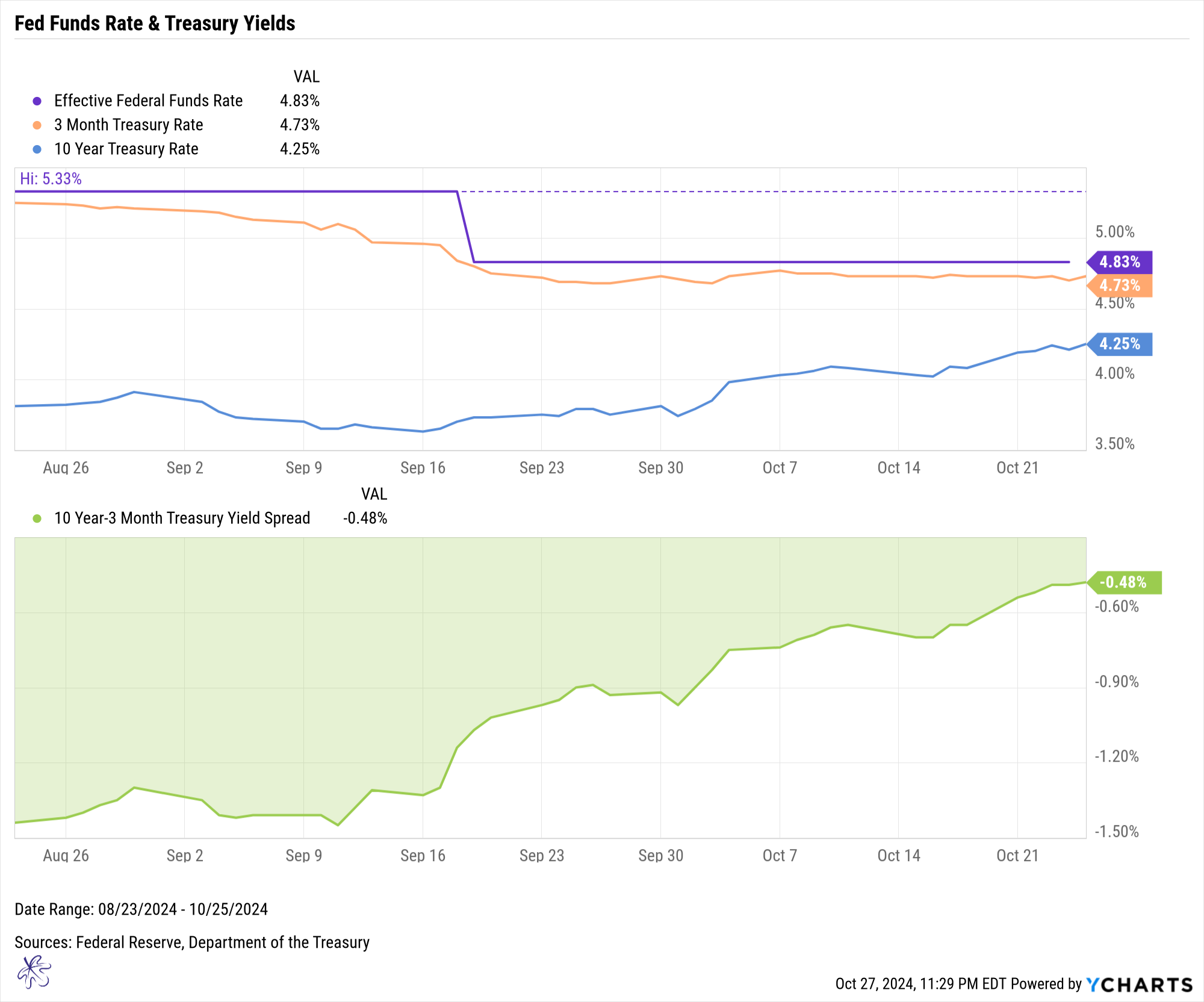

On September 18, the FOMC cut the Federal Funds Rate (purple line) by 50 basis points, from 5.33% to 4.83%. As a result, the 3-month Treasury rate fell from 5.19% on September 3 to 4.73% as of October 24. During the same period, however, the 10-year Treasury rate rose from 3.84% to 4.25%.

The effect? The 10-year minus 3-month Treasury yield curve has steepened, shifting from -135 basis points to -48 basis points. This steepening, where long-term rates rise while short-term rates fall, signals that the market may be anticipating future economic growth or potential inflationary pressures, both of which maypush long-term rates higher.

Understanding the Treasury Curve and Federal Funds Rate Impact

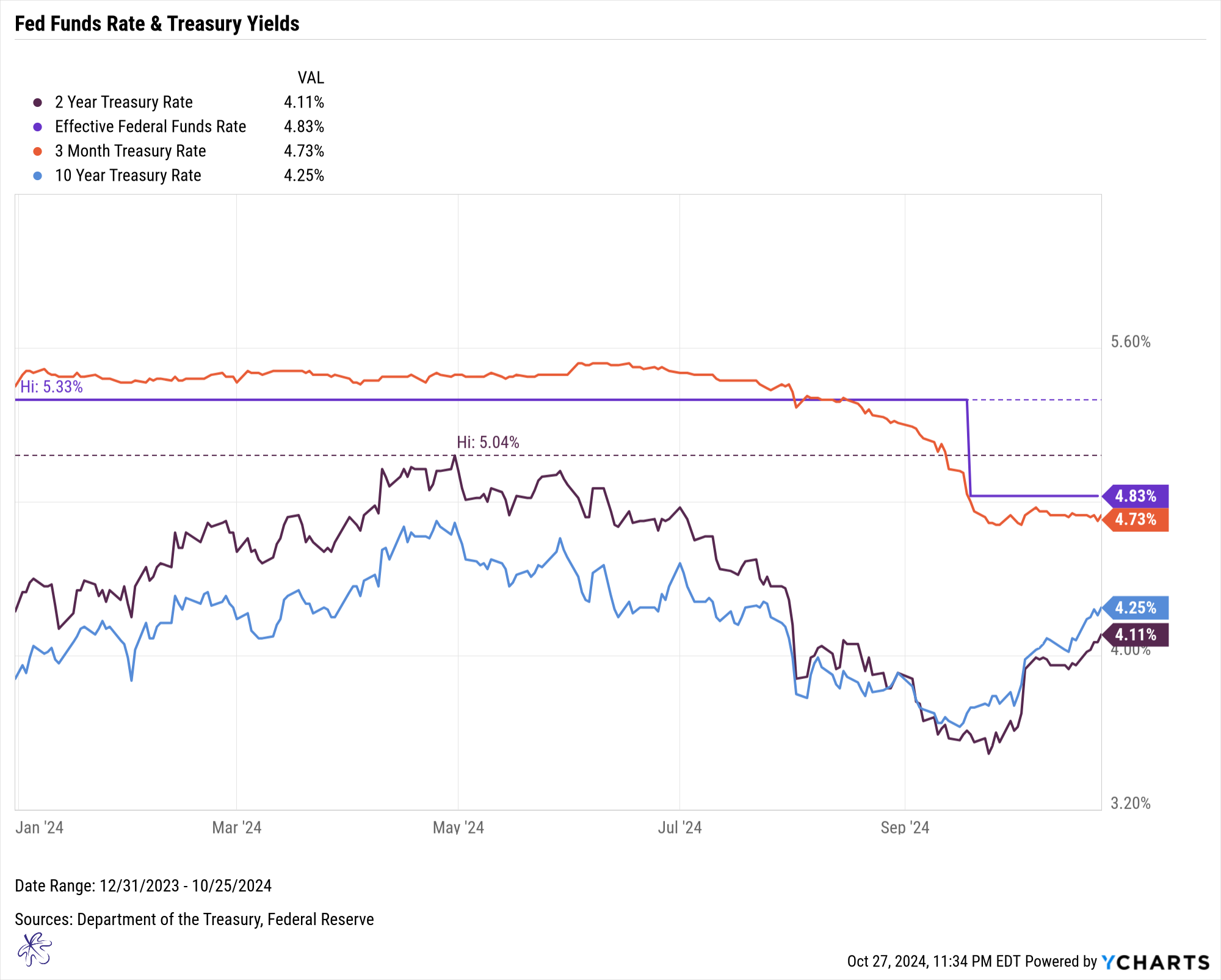

The Federal Reserve primarily influences the front end of the yield curve through the Federal Funds Rate, which is best represented by the 3-month Treasury yield in this chart. Rates for the 2-year and 10-year Treasuries shift in anticipation of future Fed actions. This expectation creates an inverted yield curve, where short-term rates are higher than long-term rates due to anticipated rate cuts down the line.

As inflation has cooled (pink line), the market has increased its expectations of a Federal Funds Rate cut. Since inflation data is lagging (we only see its impact after it’s already occurred), the market anticipates that as the Fed cuts rates, inflation will eventually stabilize. However, the market is also pricing in the possibility that inflation may rise again.

But this shift in rates isn’t happening due to one rate cut alone. It reflects the market’s expectations of a series of rate cuts.

Long-Term Market Expectations for Rate Cuts

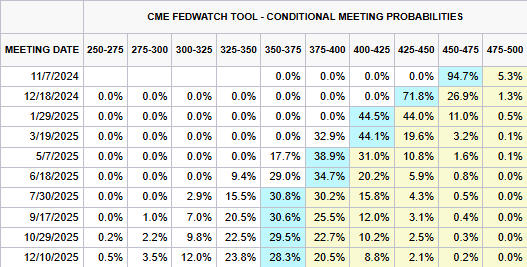

Source: CME Group FedWatch Tool, as of 10-24-24

The market currently anticipates regular rate cuts over the next year, with a projected terminal rate around 3.5%. If this anticipated path materializes, short-term rates are likely to decrease, while longer-term rates may stay the same or even rise; assuming the economic data continues to be robust. But that’s a big assumption.

How Will These Rate Changes Impact You?

So, what does this mean for rates that directly affect your finances?

Mortgage Rates

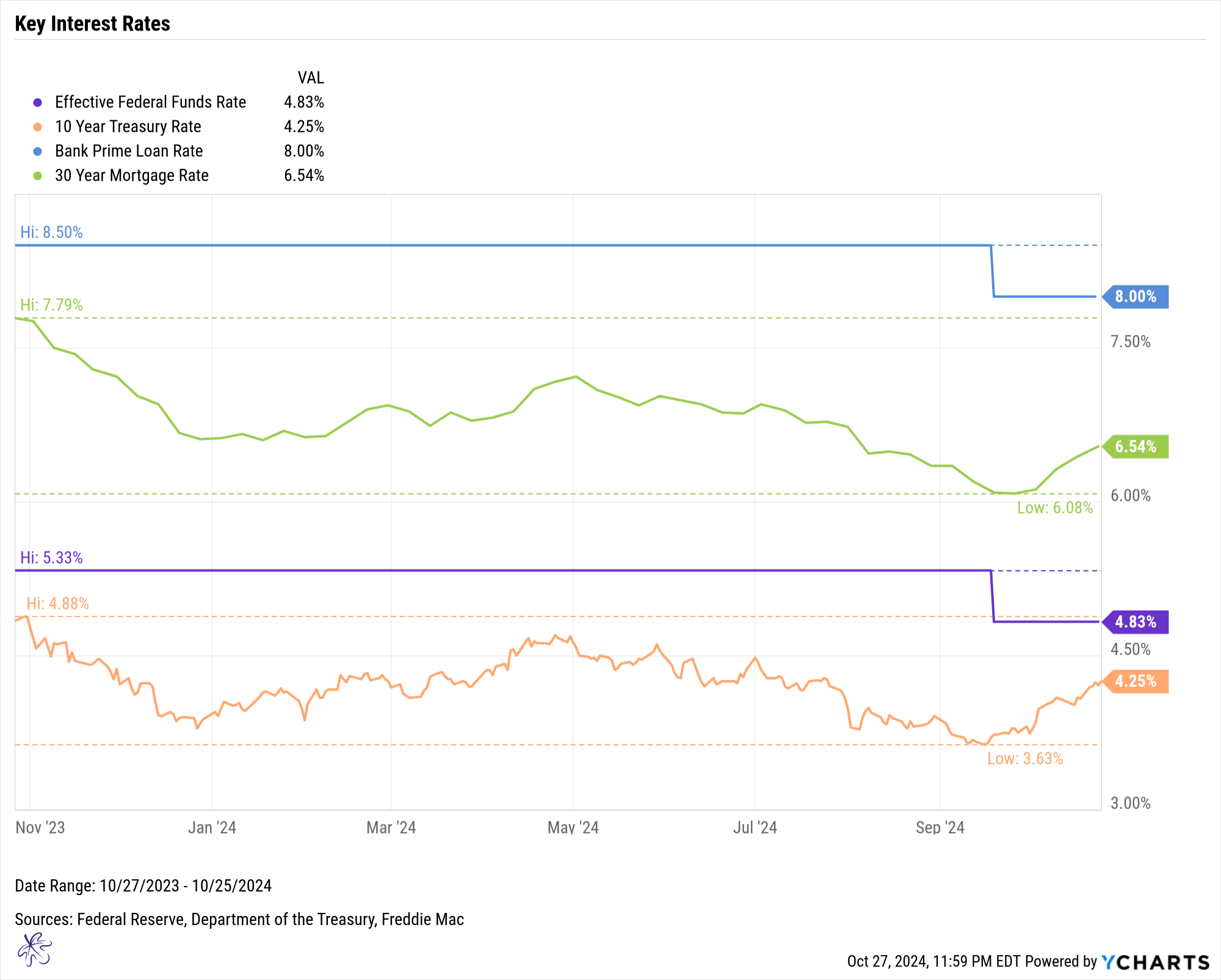

Many consumers mistakenly believe that the Fed Funds Rate directly affects mortgage rates. In reality, mortgage rates are more closely tied to the 10-year Treasury rate. Notice how the 10-year rate (orange line) and the 30-year mortgage rate (green line) move in near synchrony, peaking and bottoming at similar points.

If you’re looking to refinance or lock in a mortgage rate, focus on the 10-year Treasury rate as your benchmark.

Prime Rate and Consumer Loans

Many loans today are pegged to the Prime Rate, which banks offer to their most creditworthy clients. This includes credit cards, home equity lines of credit, small business loans, and adjustable-rate mortgages (ARMs). The Prime Rate generally moves in lockstep with the Federal Funds Rate.

With the recent rate cut, the Prime Rate dropped by the same 0.50%, meaning consumers with these loan types may see lower repayment amounts in the coming months. If further rate cuts occur as expected, rates could fall by another 1.25% to a terminal rate of 6.75%.

However, there’s a trade-off: as consumers pay less interest, they may have more to spend, potentially driving inflation. This is how the FOMC uses interest rates to influence spending and control inflation through tights and easy monetary policy.

The Exception: Market Volatility and Safe-Haven Yields

In the case of market volatility, such as a sell-off or an unexpected event, investors may shift from equities to safe-haven assets like long-term Treasuries. This demand increases Treasury prices, driving long-term yields lower. This shift could result in lower mortgage rates unless credit spreads widen, although spreads are currently at their lowest levels in two decades. But that’s a topic for another day.

If a risk off event does occur, the Yield curve can still steepen because it would anticipate that the FOMC will cut short term rates further and faster than the contraction in long term rates.

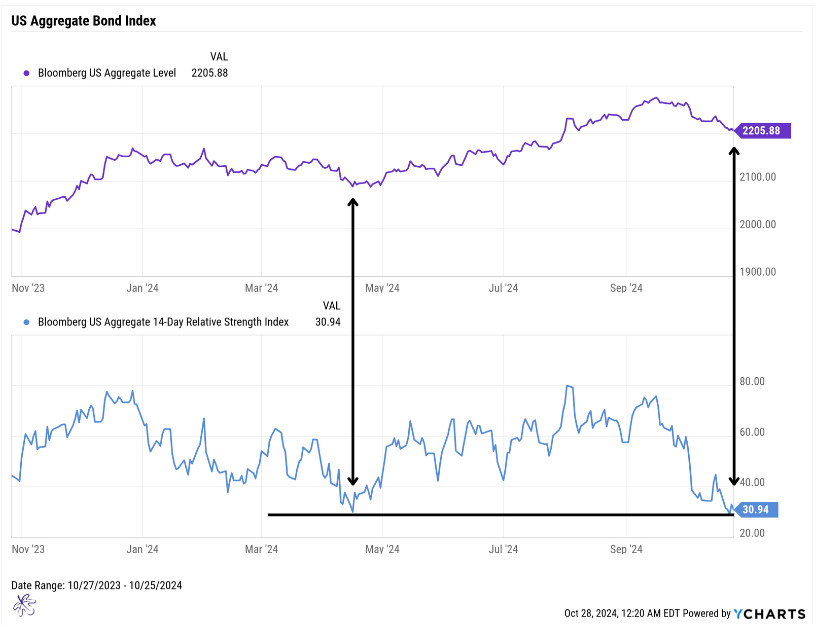

The Short-Term Bond Outlook: A Technical Perspective

In the short term, bond prices have dropped, increasing yields to a point where the Relative Strength Index (RSI) signals an oversold condition. The last time we saw similar conditions was in April 2024, after which the bond market rallied significantly. For example, the 10-year Treasury rate fell from 4.67% on April 15 to 3.63% on September 16.

Based on this scenario, there may be a better opportunity in the near future to lock in rates on a mortgage refinance or purchase is bond prices rally off of these oversold conditions.

Final Thoughts: Why an Advisor Can Add Value

In today’s fast-paced financial landscape, it’s challenging to keep track of every market movement, yield curve shift, or Fed policy adjustment. These subtle yet impactful changes could greatly influence personal finances, from mortgage rates to loan repayments and investment opportunities.

This is where we believe a knowledgeable advisor becomes important. They not only monitor these evolving trends but also interpret how they intersect with your financial goals. By staying ahead of these factors, an advisor may help pinpoint the best moments to act - whether it’s refinancing, managing debt, or adjusting your investment strategy for stability and growth. If you are curious about how a financial advisor could help you with your personal situation, please send me a note.