Will rising Commodities throw a wrench in the Fed’s rate cut plans?

Rising commodity prices are quietly breaking away from falling inflation trends. Could this upend the market’s obsession with rate cuts and foil the Fed’s rate cutting plans?

Inflation continues to dominate headlines, with the stock market seemingly hanging on every word from the Federal Reserve. Investors are laser-focused on whether rate cuts will continue, but could rising commodity prices throw a wrench in these plans?

Summary:

- The President has called for lower rates

- Commodities and inflation tend to move together, but now we are seeing a dispersion

- If Commodity continue to break out, the Fed may be forced to hold rates steady or even increase them

But is the market betting too heavily on a narrative of falling inflation and rate cuts?

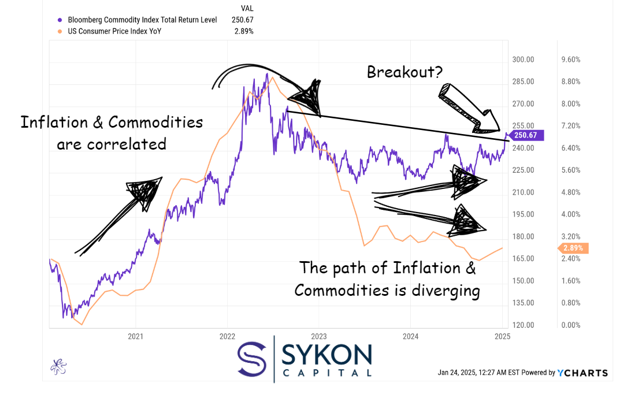

In my opinion, the market is addicted to low interest rates. The chart above highlights the strong correlation between the Bloomberg Commodity Index and the year-over-year change in the U.S. Consumer Price Index (CPI). This relationship isn’t surprising: supply and demand dynamics in commodity markets often drive inflation. Rising commodity prices ripple across industries, raising costs and ultimately pushing consumer prices higher. On the flip side, commodities like gold are traditionally viewed as hedges against inflation, reinforcing the connection.

During the recent inflation surge, both CPI and commodity prices climbed in tandem before rolling over together. But now, we’re seeing a significant divergence. While year-over-year CPI has been declining, the Bloomberg Commodity Index has started inching higher.

This divergence could have major implications. If commodity prices are breaking out of their two-year downtrend, as recent moves suggest, this could signal a resurgence in inflationary pressures that could derail hopes for lower interest rates. For investors, this is a dynamic worth watching closely, especially since the Federal Reserve may be forced to hold rates steady or even tighten if inflation risks return.

The behavioral side of this is worth noting too. The market’s reliance on low rates highlights a broader issue: the addiction to monetary policy support. Investors have grown so accustomed to rate cuts as the default solution that any deviation from this script could trigger heightened volatility, or what’s often referred to as a “market tantrum.”

As we move forward in 2025, we believe it’s critical for investors to remain vigilant. Watching commodity trends like energy, industrial metals, and agricultural goods could provide early warning signs of inflationary pressures. While the promise of lower rates fuels optimism in the short term, focusing on resilience and staying grounded in broader market realities we think will be key to navigating whatever lies ahead.

Be sure to follow me as we unravel this trend.